Api Management Size

Market Size Snapshot

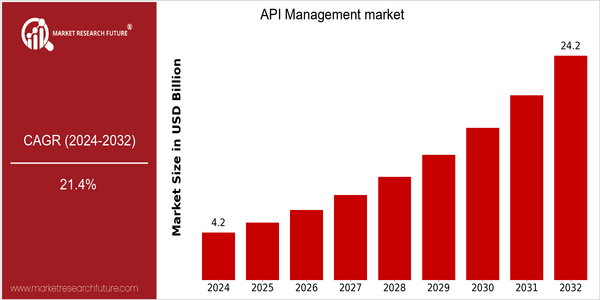

| Year | Value |

|---|---|

| 2024 | USD 4.22 Billion |

| 2032 | USD 24.17 Billion |

| CAGR (2024-2032) | 21.4 % |

Note – Market size depicts the revenue generated over the financial year

The API Management market is expected to grow at a CAGR of 21.6% from 2024 to 2032. This growth rate will be maintained throughout the forecast period. This growth is due to the increased use of APIs by companies pursuing digital transformation and increased interoperability across platforms and services. The growing popularity of cloud services, the proliferation of mobile applications, and the need for seamless integration of disparate systems will also drive the growth of the market. The need for advanced API management solutions will also increase as companies continue to rely on APIs to facilitate interoperability and optimize their operations. The major players in this market, such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform, are investing in new technology and forming strategic alliances to enhance their offerings. Recent product launches and strategic alliances to improve security and scalability have also been contributing to the growth of the market.

Regional Market Size

Regional Deep Dive

During the last five years, the market for API management has grown rapidly in many regions, primarily driven by the growing need to integrate applications and services. In North America, the market is characterized by a high level of cloud-based solutions and a high focus on digital transformation. Europe is a diverse market with a varied regulatory framework that affects the API strategy. Asia-Pacific is a rapidly evolving market, driven by the explosion of mobile applications and IoT devices. The Middle East and Africa are gradually moving towards digitalization, and Latin America is primarily looking for API management to increase operational efficiency and customer engagement.

Europe

- The European Union's General Data Protection Regulation (GDPR) has significantly influenced API management strategies, compelling organizations to prioritize data privacy and security in their API offerings.

- Innovations in API monetization models are emerging, with companies like Axway and MuleSoft leading initiatives to help businesses generate revenue through their APIs.

Asia Pacific

- The rapid growth of mobile applications and the Internet of Things (IoT) in countries like India and China is driving demand for API management solutions, with local players such as WSO2 gaining traction.

- Government initiatives, such as Singapore's Smart Nation program, are fostering an environment conducive to API development, encouraging public and private sector collaboration.

Latin America

- The growing emphasis on digital transformation in Brazil and Mexico is driving the adoption of API management solutions, with local startups emerging to address specific market needs.

- Regulatory changes in the financial sector, such as open banking initiatives, are pushing banks to adopt API management strategies to enhance customer experiences and foster competition.

North America

- The rise of cloud-native architectures has led to increased investments in API management solutions, with companies like Google Cloud and Amazon Web Services launching new features to enhance API security and scalability.

- Regulatory changes, such as the California Consumer Privacy Act (CCPA), are prompting organizations to adopt more robust API management practices to ensure compliance and protect consumer data.

Middle East And Africa

- The UAE's Vision 2021 initiative is promoting digital transformation across various sectors, leading to increased investments in API management solutions to enhance service delivery.

- Emerging fintech companies in Africa are leveraging API management to create innovative financial services, with organizations like Flutterwave and Paystack at the forefront.

Did You Know?

“Over 80% of organizations are expected to adopt API management solutions by 2025, highlighting the critical role APIs play in digital transformation.” — Gartner

Segmental Market Size

The API Management segment is playing a crucial role in the overall market by enabling the integration and communication of various software applications. This market is undergoing a strong growth phase, driven by the increasing demand for digital transformation across various industries. The demand for microservices is increasing, which requires the implementation of efficient API management solutions. In the current market, the maturity of the API Management market is in progress. Major players such as Amazon Web Services, Microsoft Azure and Google Cloud Platform have implemented advanced API management solutions. These solutions are primarily used in e-commerce, financial services and health care systems to enable real-time data exchange and service interoperability. The trend towards cloud-native applications and the increased importance of data privacy regulations such as the GDPR are accelerating the growth of this market. The evolution of this market is largely influenced by the introduction of gateways, analytic tools and security solutions, which ensure that companies can manage their APIs effectively while maintaining compliance and security.

Future Outlook

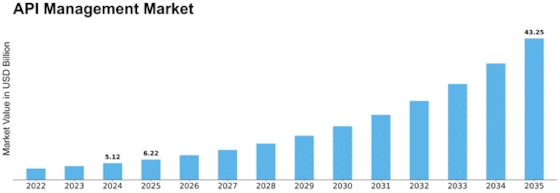

From 2024 to 2032, the API management market will grow from $4.2 billion to $24 billion, at a robust CAGR of 21.4 percent. It will be driven by digital transformation initiatives across industries, as organizations seek to improve their business performance and customer engagement through the seamless integration of applications and services. By 2032, over 70 percent of enterprises will use API management to enable their digital ecosystems, indicating the importance of APIs in modern business strategies. Moreover, technological innovations such as the rise of cloud-native applications, microservices, and the Internet of Things will further drive demand for API management solutions. As APIs become the backbone of digital business strategies, they will require robust and secure management tools to ensure scalability, performance, and security. Among other factors, the growing importance of security and governance, and the integration of artificial intelligence and machine learning in API management platforms will shape the market. Moreover, as organizations struggle to comply with regulations and deliver superior customer experiences, the API management market will evolve into a critical component of the enterprise IT infrastructure, accelerating innovation and growth.

Leave a Comment