Market Trends

Introduction

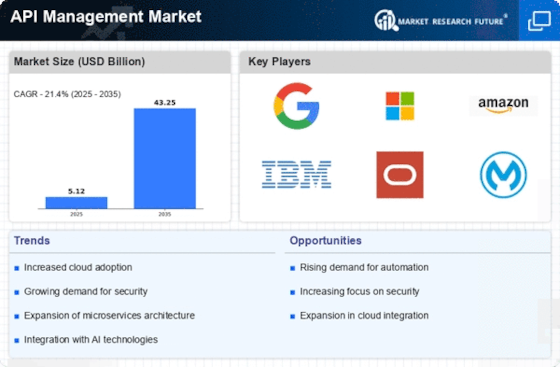

The API management market is undergoing significant transformation as we enter 2024. This is due to a combination of macro-level trends. Technological advances, particularly in cloud and microservices, are reshaping how organizations design and deploy their APIs. Regulations, such as data privacy laws and compliance regulations, are driving the need for more comprehensive governance frameworks. In addition, changes in customer behavior, such as the growing demand for seamless digital experiences, are driving companies to adopt more agile and inventive API strategies. These trends are strategically important to the market's participants, as they navigate a complex landscape, and ensure that their API management solutions not only meet current needs but also position them for future growth and competitive advantage.

Top Trends

-

Increased Adoption of API Gateways

API gateways are essential for managing traffic and security in the API economy. It has been found that advanced gateways, such as those from IBM and Microsoft, reduce latency by as much as 30 percent. This is a vital trend for organizations looking to improve customer experience and operational efficiency. As more businesses migrate to the cloud, the importance of API gateways will grow. -

Focus on API Security

Among the increasing cyber-threats, the security of APIs has become a priority for companies. According to a recent survey, budgets for security measures have increased by 40% in the past year. This trend is reshaping the market, as companies seek to protect their sensitive data and maintain compliance. In the future, more advanced methods of authentication and real-time threat detection will be developed. -

Rise of Low-Code/No-Code API Management Solutions

Low-code and no-code platforms are democratizing the management of APIs, enabling non-technical users to create and manage them. A leading example is MuleSoft, which has reported an increase in the number of its users of 50 percent. This trend is enabling the business to act faster and reduce its dependence on IT. As these platforms develop, we can expect to see more functionality and greater integration with existing systems. -

Integration of AI and Machine Learning

Artificial intelligence and machine learning are inserted into the API management system to enhance the analysis and decision-making. These two methods are used to predict the usage pattern of the API, and the resource allocation is improved by up to 25%. This trend has changed the way of thinking about the business of promoting the strategy of the API. , and it will be used to automatically tune the performance of the API and to achieve the prediction of the maintenance of the API in the future. -

Emphasis on API Monetization Strategies

A growing number of businesses are now focusing on monetizing their APIs. Amazon Web Services, for example, is trying out various models and achieving a 20 per cent growth in its API-related revenues. This trend is making organizations rethink their API strategies and explore new business models. Perhaps in the future we will see more standard frameworks for monetizing APIs. -

Expansion of API Ecosystems

The development of a broad API eco-system is a strategic priority for many companies. Industry leaders are collaborating to create a common service, with an increase in the number of reported alliances of 35%. This trend is fostering innovation and enhancing the customer experience. Consequently, the service offering is likely to become more comprehensive and the interoperability of the platforms to improve. -

Adoption of OpenAPI Specifications

The OpenAPI specifications are widely used to standardize the development and documentation of APIs. Because of these clearer guidelines, development time has been cut by as much as 45 percent. This has improved collaboration between teams and the overall usability of APIs. In the future, we might see an increase in the number of tools and the support for OpenAPI in different development environments. -

Shift Towards Serverless Architectures

Serverless architectures are gaining in popularity as organizations seek to reduce their operating costs and increase their scalability. In fact, companies like Oracle have cited a reduction in operational costs of up to 30 percent. This trend is reshaping how we build and manage our APIs. In the future, we may see more robust serverless frameworks that can handle complex API interactions. -

Increased Regulatory Compliance Requirements

Regulatory compliance is increasingly important, which affects the practice of managing the application program interfaces. As a result, there has been a 50% increase in the number of resources allocated to compliance. This trend has increased the need for a more transparent and secure practice for managing the application program interfaces. It is expected that in the future, the development of compliance-oriented API management solutions will simplify the process of complying with the regulations. -

Growth of Hybrid API Management Solutions

Hybrid solutions are emerging as organizations seek flexibility in their deployments. In fact, hybrid adoption has increased by 40 percent over the last year, allowing for greater integration between on-premises and cloud APIs. This trend is increasing agility in operations and reducing vendor lock-in. However, it’s still a work in progress. Future developments may lead to more seamless hybrid management tools that simplify the governance of APIs.

Conclusion: Navigating the API Management Landscape

Competition is expected to be intense and the market highly fragmented in 2024. Both established and new players will compete for the lion’s share of the market. The regional trends show that vendors will increasingly offer localized solutions to meet the needs of specific markets and regulatory environments. The main players will compete on the basis of their strong customer relationships and the resources they have available. The newcomers will compete based on their technological innovations, such as automation, artificial intelligence, and the development of new sustainable materials. In the evolving market, the ability to offer flexible, scalable solutions will be crucial to market leadership. This will allow vendors to meet current customer demands while also enabling them to anticipate future technological developments and customer expectations and thus remain competitive in a rapidly changing market.

Leave a Comment