Growing Focus on DevOps Practices

The Application Development Deployment Software Market is significantly influenced by the growing adoption of DevOps practices. This methodology emphasizes collaboration between development and operations teams, leading to faster deployment cycles and improved software quality. Recent statistics indicate that organizations implementing DevOps can achieve deployment frequency that is 30 times higher than those that do not. As companies strive for agility and efficiency, the demand for software that supports DevOps processes is expected to rise. This trend not only enhances productivity but also aligns with the broader objectives of digital transformation, thereby propelling the Application Development Deployment Software Market forward.

Increased Demand for Cloud Solutions

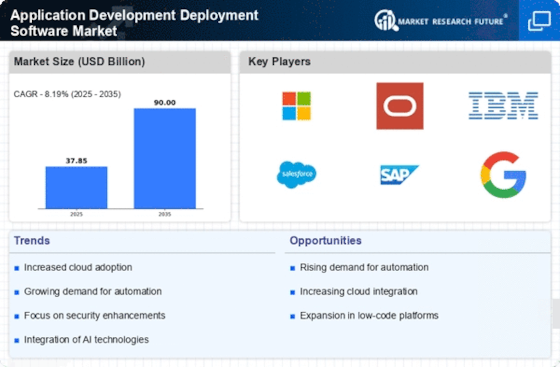

The Application Development Deployment Software Market experiences a notable surge in demand for cloud-based solutions. Organizations are increasingly migrating their applications to the cloud to enhance scalability, flexibility, and cost-effectiveness. According to recent data, the cloud application market is projected to grow at a compound annual growth rate of over 20% in the coming years. This shift not only facilitates easier deployment but also allows for seamless updates and maintenance, which are critical for businesses aiming to stay competitive. As more enterprises adopt cloud technologies, the Application Development Deployment Software Market is likely to expand, driven by the need for integrated solutions that support remote work and collaboration.

Rising Need for Enhanced Security Features

In the context of the Application Development Deployment Software Market, the increasing emphasis on security and compliance is becoming a pivotal driver. With the rise in cyber threats, organizations are prioritizing the integration of robust security features within their application development processes. Data suggests that The Application Development Deployment Software Market is anticipated to reach over 300 billion dollars by 2024, reflecting the urgency for secure software solutions. Consequently, software providers are compelled to innovate and offer enhanced security measures, such as automated vulnerability assessments and compliance tracking, to meet the evolving demands of businesses. This focus on security is likely to shape the future landscape of the Application Development Deployment Software Market.

Emergence of Low-Code and No-Code Platforms

The Application Development Deployment Software Market is being transformed by the emergence of low-code and no-code platforms. These solutions enable users with minimal programming knowledge to develop applications rapidly, thereby democratizing the development process. Recent analyses suggest that the low-code development market could reach 45 billion dollars by 2025, reflecting a shift towards more accessible application development. This trend is particularly appealing to businesses seeking to accelerate their digital transformation initiatives without the need for extensive coding expertise. As organizations increasingly adopt these platforms, the Application Development Deployment Software Market is likely to evolve, fostering a new wave of innovation and user engagement.

Expansion of Mobile Application Development

The Application Development Deployment Software Market is witnessing a significant expansion in mobile application development. As mobile devices become ubiquitous, businesses are increasingly investing in mobile applications to enhance customer engagement and streamline operations. Recent reports indicate that mobile app revenues are projected to exceed 500 billion dollars by 2025, underscoring the lucrative opportunities within this sector. This trend necessitates the development of specialized deployment software that can efficiently manage mobile app lifecycles, from development to deployment. As a result, the Application Development Deployment Software Market is likely to benefit from this growing focus on mobile solutions, driving innovation and competition among software providers.