Mobile Application Development Platform Market Summary

As per Market Research Future analysis, the Mobile Application Development Platform Market Size was estimated at 15.93 USD Billion in 2024. The Mobile Application Development Platform industry is projected to grow from 19.57 USD Billion in 2025 to 153.39 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 22.86% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Mobile Application Development Platform Market is experiencing transformative growth driven by technological advancements and evolving user needs.

- The rise of low-code development platforms is democratizing app creation, enabling users with minimal coding skills to participate.

- Integration of AI and machine learning is enhancing app functionalities, providing personalized user experiences and predictive analytics.

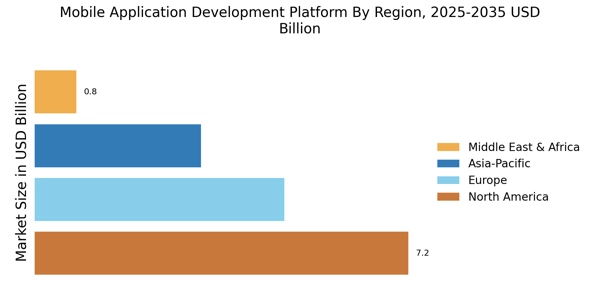

- In North America, the demand for robust security and compliance measures is shaping development practices, while Asia-Pacific is rapidly adopting innovative solutions.

- The increased demand for mobile applications and the emergence of cross-platform development are key drivers propelling growth in both cloud and on-premises segments.

Market Size & Forecast

| 2024 Market Size | 15.93 (USD Billion) |

| 2035 Market Size | 153.39 (USD Billion) |

| CAGR (2025 - 2035) | 22.86% |

Major Players

Microsoft (US), Google (US), Apple (US), IBM (US), Salesforce (US), Oracle (US), SAP (DE), Appian (US), OutSystems (PT), Mendix (NL)