Top Industry Leaders in the Application Security Market

Competitive Landscape of the Application Security Market:

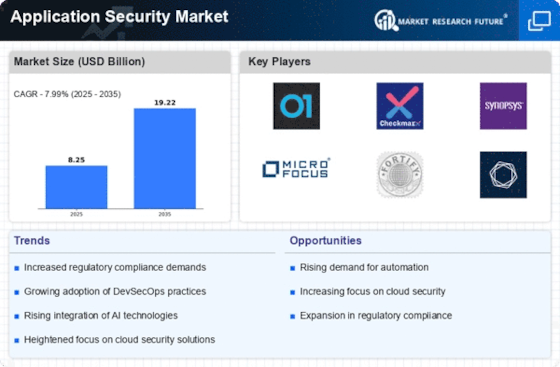

The global application security market is experiencing significant growth due to the increasing adoption of cloud-based applications, mobile technologies, and the growing number of cyber threats. With the rising awareness of data breaches and the need for stringent security measures, businesses are investing heavily in application security solutions. This has led to a dynamic and competitive landscape in the market.

Key Players:

- Veracode (US.)

- HPE (US.)

- Synopsys (US.)

- IBM (US.)

- WhiteHat Security (US.)

- Qualys (US.)

- Checkmarx (Israel)

- Acunetix (Malta)

- Rapid7 (US.)

- Trustwave (US.)

- High-Tech Bridge (Switzerland)

- Contrast Security (US.)

Strategies Adopted:

Key players in the application security market are focusing on various strategies to gain a competitive edge. These include:

- Expanding product portfolios: Companies are continuously developing and adding new solutions to their portfolio to address the evolving security landscape. This includes offering solutions for emerging threats such as API security and bot management.

- Acquisitions and mergers: Companies are actively acquiring smaller players to expand their market share and expertise in specific areas of application security.

- Focus on cloud-based solutions: With the increasing adoption of cloud-based applications, companies are developing and offering cloud-native application security solutions that are easy to use and integrate with existing cloud infrastructure.

- Partnerships and collaborations: Companies are partnering with other technology vendors and security service providers to offer comprehensive and integrated application security solutions.

- Focus on compliance and regulatory requirements: Many companies are focusing on developing solutions that help organizations comply with industry-specific regulations and standards.

Factors for Market Share Analysis:

Several factors contribute to market share analysis in the application security market, including:

- Market size and growth: The size and projected growth of the market segment that the company operates in.

- Product portfolio: The breadth and depth of the company's application security solutions.

- Customer base: The number and type of customers that the company serves.

- Geographic reach: The company's presence in different geographic markets.

- Financial performance: The company's revenue, profitability, and growth rate.

- Brand reputation: The company's brand recognition and reputation in the market.

New and Emerging Companies:

Several new and emerging companies are entering the application security market with innovative solutions. These companies are often focusing on specific niche areas of application security, such as API security, serverless security, and mobile application security. Some notable examples include:

- Snyk: A leader in open-source security, Snyk offers automated solutions for detecting and fixing vulnerabilities in open-source libraries used in applications.

- Arkose Labs: A provider of bot management solutions, Arkose Labs helps companies protect their applications from automated bots that are designed to launch cyberattacks.

- Salt Security: A provider of API security solutions, Salt Security helps companies protect their APIs from unauthorized access and data breaches.

Current Company Investment Trends:

Current investment trends in the application security market reflect the growing awareness of the importance of application security and the need for comprehensive solutions. Some key trends include:

- Focus on cloud security: Companies are investing heavily in cloud-based application security solutions to protect their applications running in the cloud.

- Investment in AI and machine learning: Companies are leveraging artificial intelligence (AI) and machine learning (ML) to automate security tasks and improve the effectiveness of their solutions.

- Focus on DevSecOps: Companies are integrating security into the development process to identify and fix vulnerabilities early in the development cycle.

- Increased adoption of SaaS solutions: Companies are increasingly opting for SaaS-based application security solutions due to their ease of deployment and management.

Latest Company Updates:

New Relic Interactive Application Security Testing (IAST) in 2023. New Relic IAST goes above and beyond current methodologies by providing visibility and context for security findings, advanced detection accuracy with near zero false positives, proof-of-exploit, and guided remediation. It helps engineers, DevOps, and security teams to focus on real security threats, resolve issues more quickly across the application lifecycle, and deploy secure code with confidence and speed.

Ghost Security will launch the Ghost Platform, the industry's most comprehensive discovery and threat detection capability for modern, cloud-native apps, in 2023. The Ghost Platform automatically discovers every application and API associated with a company, mapping and understanding the connections each has to important data and ensuring that threats are discovered and prioritised instantly.

At Black Hat USA 2023, Bionic, the first Application Security Posture Management (ASPM) platform in the market, unveiled a number of new product developments to assist businesses in managing application risk in production in 2023. A new ServiceNow® Service Graph Connector from Bionic gives engineering and security teams instant access to a real-time configuration management database (CMDB) of their microservices, cloud apps, and dependencies while they're in production.