Market Analysis

In-depth Analysis of Applied AI in Retail & E-commerce Market Industry Landscape

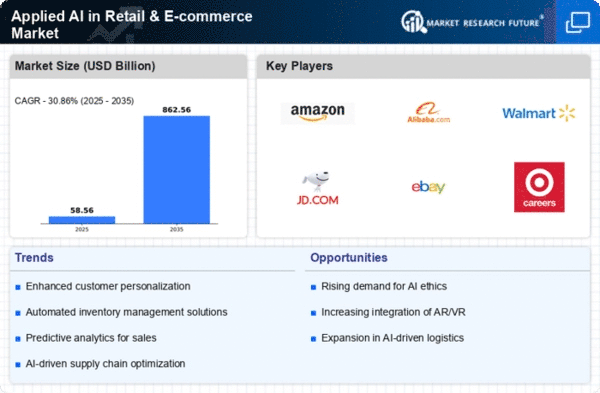

Applied AI in Retail & E-commerce Market is a constantly evolving influential sector affected by multiple factors shaping its direction such as retail growth and online commerce rebirths. A major driver behind its expansion includes growing number of companies who realize the transformative role of AI technologies in enhancing customer experience, optimizing operations and improving operational efficiency. As such, Applied Artificial Intelligence (AI) becomes a critical instrument for personalization, predictive analytics and operation automation among retailers and e-commerce platforms struggling to maintain their competitiveness in the fast-changing market. Technological advancement is essential to the Applied AI in Retail & E-commerce Market. Improved artificial intelligence algorithms, machine learning models and natural language processing contribute to smart solutions that can analyze massive amounts of consumer data. Some of the innovations that have been taking place on the market include AI-driven recommendation engines, personalized marketing, demand forecasting as well as chatbot enabled customer service which are all geared towards empowering retailers and e-commerce players with data-driven insights as well as automation abilities. On the other hand, it should be noted that global economic conditions significantly influence applied AI in Retail & E-commerce Market. Global economy fluctuations can affect customers’ spending habits thus impacting investment decisions made by retail or e-commerce firms relating to AI-backed technologies adoption. In times of economic growth, more funds tend to flow into new technological developments hence fostering innovation for retail and e-commerce AI solutions. Contrarily, during an economic slowdown, a more cautious approach is taken thus affecting levels of investments within this sector leading to decreased rates of development in retail/e-commerce AI industry. Regulatory turbulence and privacy issues are essential elements in the Applied AI in Retail & E-commerce Market. Retail operations are intrinsically integrated with AI technology, thus necessitating the introduction of legal frameworks that regulate customer’s privacy, data security as well as ethical considerations. Compliance with regulations and being able to show responsible and ethical use of AI is crucial for companies involved in developing and implementing AI solutions in the retailing and e-commerce sector. The competitive landscape acts as a major driver for Applied AI in Retail & E-commerce Market. The retail market is flooded with different companies providing AI powered solutions therefore making competition stiffer than ever. When choosing an artificial intelligence solution, retailers and e-commerce platforms must consider factors such as the accuracy of their algorithms, how scalable they are, what customers’ experience will be like on them as well as how personalized they can make shopping experiences seamless. This is a fast moving industry where continuous innovation helps address unique challenges posed by retailing.

Leave a Comment