Market Trends

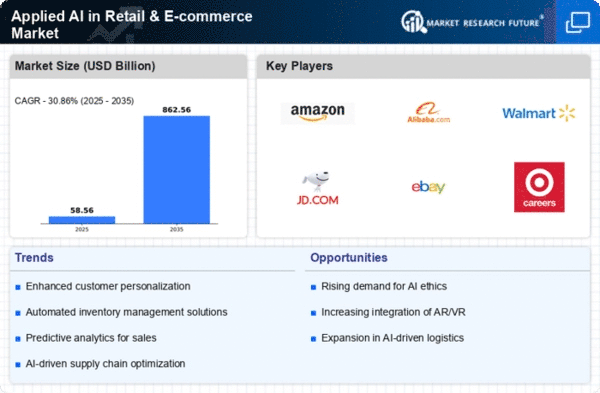

Key Emerging Trends in the Applied AI in Retail & E-commerce Market

In response to this rapidly changing environment, firms have turned to strategies that enable them consolidate or expand their market shares within the application of Artificial Intelligence (AI) on Retail & E-Commerce Marketplaces. One way to approach it is through focus on technological innovation to develop and offer advanced capable solutions that are customized according to requirements of retail (shopping) outlets and e-shopping sectors. Therefore, using latest technologies in machine learning, natural language processing (NLP), computer vision help brands reach out personalized responses when seeking for efficient inventory management options or customer engagement tools used in online marketing campaigns. The pricing strategy plays a significant role when positioning oneself within the market share space in Applied AI in Retail & E-commerce Market. Some businesses adopt cost leadership strategy aiming at offering lower priced artificial intelligent solutions compared to their competitors targeting price sensitive retailers and e-markets ensuring competitive prices so that they obtain large market share nevertheless others position themselves as premium providers emphasizing features such as advanced recommendation engines, personalized shopping experiences, and comprehensive data analytics. Companies like these target high-end retail brands and online platforms where a segment of consumers that are willing to pay premium prices for the most modernized AI-based solutions in the field of retail. In addition, market share positioning is also influenced by collaborations and strategic partnerships within Applied AI in Retail & E-commerce Market. Many companies flirt with alliances involving e-marketplace platforms, brick-and-mortar retailers or parcel delivery services to improve how their AI solutions can be used in retail sector. Through this collaboration, they have been able to develop a wider range of services for different retailers giving them a better market reach while at the same time addressing any unique requirements from each retailer. Furthermore, partnering with established retail chain owners or major online stores on joint projects or long-term supply contracts gives them a stable income source with stronger presence in the market. Customer-centric strategies are vital to increasing market share within the Applied AI in Retail & E-commerce Market position. Firms that concentrate on offering seamless buying encounters backed by personalized suggestions and responsive customer care establish strong bonds with retailers and e-consumers alike. This way, positive user experiences lead to customer loyalty among others leading to increased market shares over time through word of mouth referrals thereby causing amplification effects. Moreover, understanding specific retail and e-commerce needs/cases enables customization of AI solutions across specific market segments resulting into competitive advantages.

Leave a Comment