Emerging Competitive Landscape

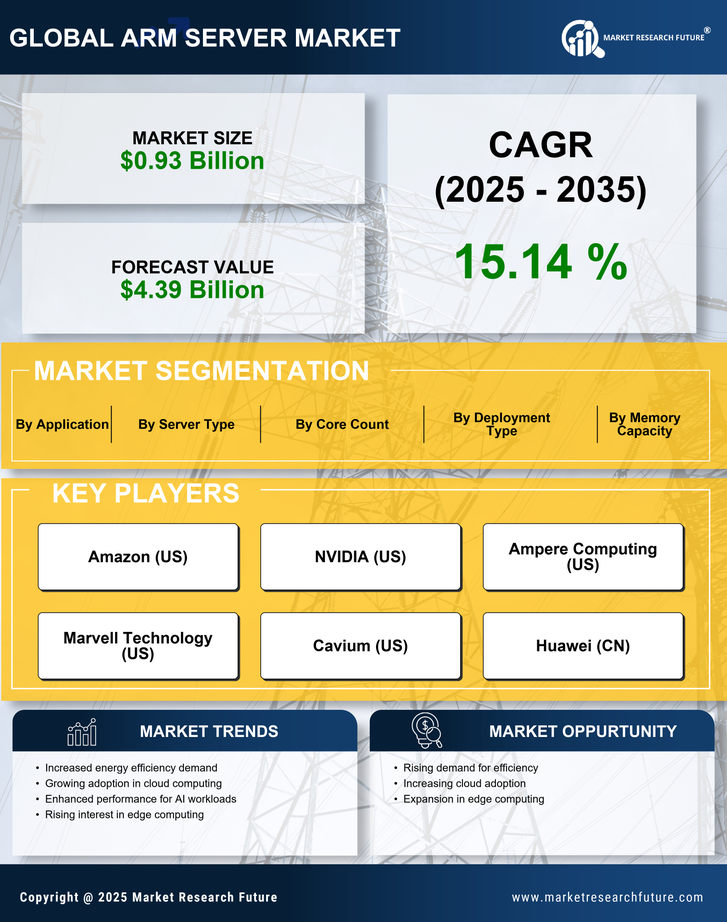

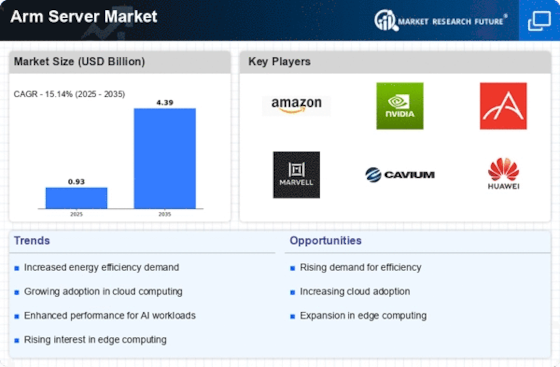

The Arm Server Market is characterized by an evolving competitive landscape, with numerous players entering the market. This influx of competition is fostering innovation and driving down prices, making Arm servers more accessible to a wider range of customers. Companies are increasingly investing in research and development to enhance the capabilities of Arm-based solutions. As a result, the market is expected to witness a compound annual growth rate of approximately 10% over the next five years. This dynamic environment presents both challenges and opportunities for existing and new entrants in the Arm Server Market.

Growth of Cloud Computing Services

The Arm Server Market is significantly influenced by the expansion of cloud computing services. As enterprises migrate to cloud-based infrastructures, the demand for scalable and efficient server solutions rises. Arm servers, with their ability to handle diverse workloads and provide high performance per watt, are well-positioned to meet these needs. Recent statistics indicate that the cloud computing market is projected to grow at a compound annual growth rate of over 15% in the coming years. This growth is likely to drive further adoption of Arm servers, as organizations seek to optimize their cloud environments.

Rising Demand for Energy Efficiency

The Arm Server Market is experiencing a notable shift towards energy efficiency, driven by increasing operational costs and environmental concerns. Organizations are actively seeking solutions that minimize energy consumption while maximizing performance. Arm servers, known for their low power requirements, are becoming increasingly attractive. According to recent data, the energy-efficient design of Arm architecture can lead to a reduction in power usage by up to 30% compared to traditional x86 servers. This trend is likely to continue as businesses prioritize sustainability and cost-effectiveness, thereby propelling the Arm Server Market forward.

Increased Adoption of Edge Computing

The Arm Server Market is witnessing a surge in the adoption of edge computing technologies. As data processing moves closer to the source of data generation, the need for efficient and compact server solutions becomes paramount. Arm servers, with their lightweight architecture, are ideally suited for edge applications, enabling real-time data processing and analytics. The edge computing market is expected to grow significantly, with estimates suggesting a market size exceeding 20 billion dollars by 2026. This trend indicates a robust opportunity for the Arm Server Market to capitalize on the demand for edge solutions.

Advancements in Artificial Intelligence

The Arm Server Market is being propelled by advancements in artificial intelligence (AI) and machine learning (ML). As organizations increasingly leverage AI for data analysis and decision-making, the need for powerful yet efficient computing solutions intensifies. Arm servers, with their ability to deliver high performance while maintaining energy efficiency, are becoming a preferred choice for AI workloads. Recent analyses suggest that the AI market could reach over 500 billion dollars by 2024, indicating a substantial opportunity for the Arm Server Market to cater to this growing demand.