Increased Demand for Automation

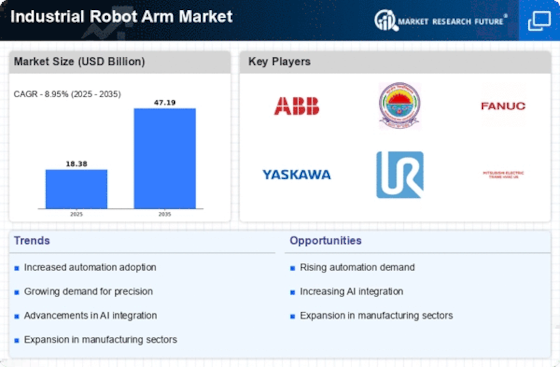

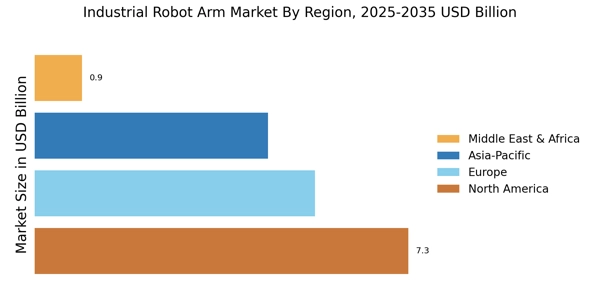

The Industrial Robot Arm Market experiences a notable surge in demand for automation across various sectors. Industries such as manufacturing, automotive, and electronics are increasingly adopting robotic arms to enhance productivity and efficiency. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is driven by the need for precision, speed, and the ability to operate in hazardous environments. As companies strive to reduce operational costs and improve output quality, the integration of industrial robot arms becomes a strategic imperative. Consequently, the Industrial Robot Arm Market is poised for substantial growth as businesses recognize the long-term benefits of automation.

Government Initiatives and Support

Government initiatives and support for automation technologies are emerging as a crucial driver for the Industrial Robot Arm Market. Various governments are implementing policies and funding programs aimed at promoting the adoption of advanced manufacturing technologies, including industrial robot arms. These initiatives often focus on enhancing competitiveness, fostering innovation, and creating jobs in high-tech sectors. For instance, grants and tax incentives for companies investing in automation can significantly lower the barriers to entry for adopting robotic solutions. As nations strive to modernize their manufacturing capabilities, the Industrial Robot Arm Market is likely to benefit from increased public and private sector collaboration, leading to accelerated growth and innovation.

Expansion of E-commerce and Logistics

The expansion of e-commerce and logistics sectors is a significant driver for the Industrial Robot Arm Market. As online shopping continues to gain traction, the demand for efficient warehousing and distribution solutions has surged. Industrial robot arms are increasingly utilized in sorting, packing, and palletizing operations, enhancing the speed and accuracy of order fulfillment. Recent statistics indicate that the e-commerce sector is expected to grow by over 15% annually, further fueling the need for automation in logistics. Companies are investing in robotic solutions to streamline operations and meet consumer expectations for rapid delivery. This trend positions the Industrial Robot Arm Market favorably, as businesses seek to optimize their supply chains through automation.

Technological Advancements in Robotics

Technological advancements play a pivotal role in shaping the Industrial Robot Arm Market. Innovations in robotics, such as enhanced sensors, improved software algorithms, and advanced materials, are driving the development of more sophisticated robotic arms. These advancements enable robots to perform complex tasks with greater accuracy and reliability. For instance, the introduction of collaborative robots, or cobots, allows for safer human-robot interaction, expanding the potential applications of industrial robot arms. The market is witnessing a shift towards more intelligent systems that can learn and adapt to their environments. As a result, the Industrial Robot Arm Market is likely to benefit from ongoing research and development efforts, leading to increased adoption rates and new applications.

Rising Labor Costs and Skills Shortages

The Industrial Robot Arm Market is significantly influenced by rising labor costs and a shortage of skilled labor. As wages continue to increase in various regions, companies are compelled to seek cost-effective solutions to maintain competitiveness. The integration of industrial robot arms offers a viable alternative, allowing businesses to automate repetitive tasks and reduce reliance on manual labor. Furthermore, the skills gap in the workforce exacerbates the need for automation, as companies struggle to find qualified personnel for specialized roles. This trend is expected to drive the demand for industrial robot arms, as organizations prioritize investments in automation technologies to mitigate labor-related challenges. Consequently, the Industrial Robot Arm Market is likely to see accelerated growth as firms adapt to these economic pressures.