Rising Healthcare Expenditure

The increase in healthcare expenditure across various regions is a significant driver for the Arterial Stents Market. As governments and private sectors allocate more resources to healthcare, the availability of advanced medical technologies, including arterial stents, improves. This trend is particularly evident in emerging economies, where rising disposable incomes and a growing middle class are leading to increased spending on healthcare services. The Arterial Stents Market stands to benefit from this trend, as more patients gain access to necessary treatments. Furthermore, the emphasis on preventive care and early intervention in cardiovascular diseases is likely to drive demand for stenting procedures, thereby fostering market growth. The correlation between healthcare investment and the adoption of innovative medical devices is expected to remain strong.

Aging Population and Lifestyle Changes

The aging population and changing lifestyles are pivotal factors driving the Arterial Stents Market. As life expectancy increases, the prevalence of age-related cardiovascular conditions rises, necessitating effective treatment options such as arterial stents. Additionally, lifestyle changes, including poor dietary habits and sedentary behavior, contribute to the growing incidence of heart diseases. This demographic shift is prompting healthcare providers to seek advanced solutions to manage cardiovascular health. The Arterial Stents Market is likely to expand as healthcare systems adapt to these demographic trends, focusing on innovative stenting solutions that cater to the needs of older patients. The interplay between aging populations and lifestyle-related health issues is expected to create a sustained demand for arterial stents.

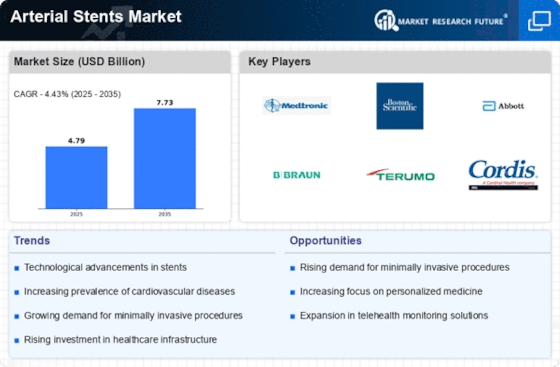

Technological Innovations in Stent Design

Technological advancements in stent design and materials are significantly influencing the Arterial Stents Market. Innovations such as drug-eluting stents and bioresorbable stents are enhancing the efficacy and safety of procedures. These advancements not only improve patient outcomes but also reduce the risk of complications, which is crucial in the treatment of cardiovascular diseases. The introduction of advanced imaging techniques and minimally invasive procedures has further propelled the market, allowing for more precise placements and better patient experiences. As the industry continues to evolve, the integration of smart technologies, such as sensors and drug delivery systems, is anticipated to revolutionize the Arterial Stents Market, potentially leading to increased adoption rates among healthcare providers.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are crucial drivers for the Arterial Stents Market. Governments and health authorities are increasingly recognizing the importance of cardiovascular health, leading to the establishment of guidelines that promote the use of arterial stents. These regulations often facilitate quicker approvals for new stent technologies, encouraging innovation within the industry. Additionally, favorable reimbursement policies enhance patient access to stenting procedures, thereby driving market growth. As healthcare systems evolve, the alignment of regulatory frameworks with technological advancements is likely to bolster the Arterial Stents Market. The ongoing collaboration between regulatory bodies and industry stakeholders is expected to create a conducive environment for the development and adoption of new stenting solutions.

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases is a primary driver for the Arterial Stents Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective treatment options escalates. According to recent data, cardiovascular diseases account for a substantial percentage of global mortality, necessitating interventions such as stenting. This trend is likely to continue, as healthcare systems increasingly prioritize cardiovascular health. The Arterial Stents Market is expected to expand in response to this growing need, with innovations in stent technology enhancing patient outcomes and driving market growth. Furthermore, the increasing awareness of heart health among patients is likely to contribute to the demand for arterial stents, as individuals seek preventive measures and treatments for existing conditions.