Rising Global Travel and Trade

The rise in The Arthropod Born Viral Infections Industry. As international travel becomes more accessible, the risk of spreading arthropod-borne diseases increases. Travelers may inadvertently carry infections to new regions, leading to outbreaks in previously unaffected areas. This trend necessitates enhanced surveillance and rapid response strategies to manage potential outbreaks. The World Health Organization has noted that the interconnectedness of populations can facilitate the transmission of these viruses. Consequently, the demand for effective diagnostics, treatments, and preventive measures is likely to surge, thereby propelling growth in the Arthropod Born Viral Infections Market.

Emerging Research and Development

Emerging research and development initiatives are driving innovation within the Arthropod Born Viral Infections Market. Scientific advancements in genomics, proteomics, and bioinformatics are enabling researchers to better understand the mechanisms of arthropod-borne viruses. This knowledge is crucial for developing targeted therapies and effective vaccines. Furthermore, collaborations between academic institutions and biotechnology firms are fostering a conducive environment for innovation. The potential for breakthroughs in treatment options and preventive measures is substantial, as ongoing research continues to unveil new insights. As a result, the Arthropod Born Viral Infections Market is poised for growth, driven by the promise of novel solutions to combat these infections.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the Arthropod Born Viral Infections Market. Various governments are recognizing the threat posed by arthropod-borne diseases and are allocating resources to combat these infections. This includes funding for research, public health campaigns, and the development of new diagnostic tools and treatments. For example, initiatives aimed at improving vector control measures and enhancing surveillance systems are being implemented in multiple regions. The financial support from governmental bodies is likely to stimulate innovation and drive growth within the market. As a result, the Arthropod Born Viral Infections Market is expected to benefit from increased investment and strategic partnerships.

Advancements in Vaccine Development

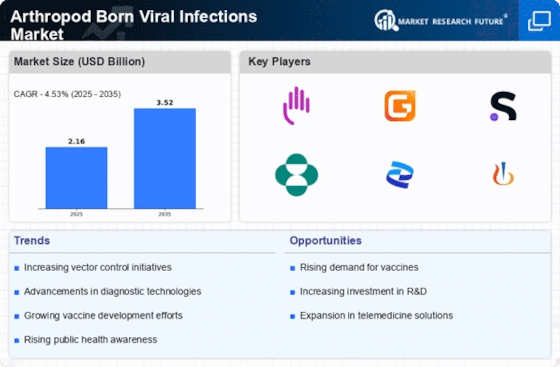

The ongoing advancements in vaccine development represent a significant driver for the Arthropod Born Viral Infections Market. Research institutions and pharmaceutical companies are investing heavily in the creation of effective vaccines against various arthropod-borne viruses. For instance, the development of vaccines for diseases like dengue and Zika has gained momentum, with several candidates entering clinical trials. The potential for successful vaccine deployment could drastically reduce the incidence of these infections, thereby influencing market dynamics. According to recent estimates, the vaccine market for vector-borne diseases is projected to reach substantial figures in the coming years. This trend indicates a promising future for the Arthropod Born Viral Infections Market as vaccination efforts expand.

Increasing Awareness of Arthropod-Borne Diseases

The rising awareness regarding arthropod-borne diseases is a crucial driver for the Arthropod Born Viral Infections Market. Public health campaigns and educational initiatives are increasingly informing populations about the risks associated with diseases such as dengue, Zika, and chikungunya. This heightened awareness is likely to lead to increased demand for preventive measures, diagnostics, and treatments. As a result, healthcare providers are focusing on developing effective strategies to combat these infections. The World Health Organization has reported a notable increase in the incidence of vector-borne diseases, which further emphasizes the need for robust healthcare responses. Consequently, the Arthropod Born Viral Infections Market is expected to experience growth as stakeholders prioritize awareness and education.