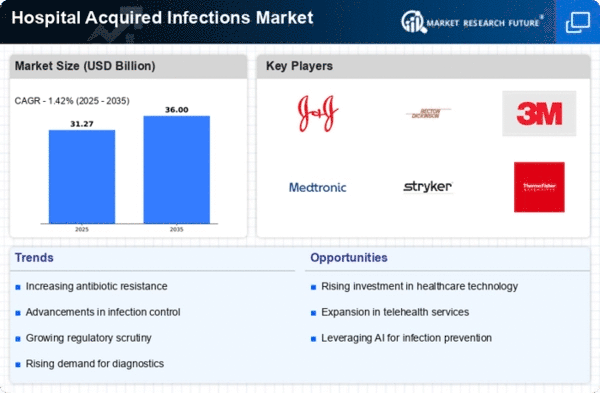

Market Growth Projections

The Global Hospital Acquired Infections Market Industry is projected to experience substantial growth in the coming years. With an estimated market value of 37.5 USD Billion in 2024, it is expected to reach 60 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.36% from 2025 to 2035, indicating a robust demand for infection control solutions. The increasing focus on patient safety, regulatory compliance, and technological advancements are likely to drive this expansion, making it a critical area of investment for healthcare providers globally.

Increase in Surgical Procedures

The growing number of surgical procedures worldwide is a significant factor driving the Global Hospital Acquired Infections Market Industry. As surgical interventions become more common, the risk of HAIs also escalates, necessitating enhanced infection control measures. Data indicates that millions of surgeries are performed annually, with a notable percentage resulting in infections. This trend compels healthcare facilities to adopt stringent infection prevention protocols and invest in advanced technologies to mitigate risks. Consequently, the market is poised for growth, reflecting the increasing demand for effective solutions to combat HAIs in surgical settings.

Government Initiatives and Regulations

Government initiatives aimed at reducing the incidence of hospital acquired infections significantly influence the Global Hospital Acquired Infections Market Industry. Various health authorities are implementing stringent regulations and guidelines to promote infection prevention practices. For example, the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO) provide frameworks that healthcare facilities must adhere to. These regulations often mandate the reporting of HAIs, which encourages hospitals to adopt better infection control measures. Consequently, the market is likely to expand as healthcare providers seek compliance and invest in necessary resources to meet these standards.

Growing Awareness of Infection Prevention

The rising awareness among healthcare professionals and patients regarding the importance of infection prevention is a key driver for the Global Hospital Acquired Infections Market Industry. Educational campaigns and training programs are increasingly emphasizing the significance of hygiene practices, handwashing, and proper use of personal protective equipment. This heightened awareness is leading to a cultural shift within healthcare settings, where infection control is prioritized. As a result, hospitals are more inclined to invest in infection prevention technologies and practices, contributing to the market's growth trajectory, which is anticipated to reach 60 USD Billion by 2035.

Technological Advancements in Infection Control

Technological innovations play a crucial role in shaping the Global Hospital Acquired Infections Market Industry. The development of advanced sterilization equipment, antimicrobial surfaces, and real-time monitoring systems enhances infection prevention strategies. For instance, the introduction of automated disinfection robots has shown promising results in reducing pathogen transmission in healthcare settings. These advancements not only improve patient outcomes but also align with regulatory requirements for infection control. As hospitals increasingly adopt these technologies, the market is expected to grow, with a projected compound annual growth rate of 4.36% from 2025 to 2035.

Rising Incidence of Hospital Acquired Infections

The increasing prevalence of hospital acquired infections (HAIs) is a primary driver of the Global Hospital Acquired Infections Market Industry. Infections such as surgical site infections, bloodstream infections, and pneumonia are becoming more common, leading to heightened awareness and demand for effective prevention and control measures. According to recent data, the global burden of HAIs is substantial, with millions of cases reported annually. This trend is likely to propel the market, which is projected to reach 37.5 USD Billion in 2024, as healthcare facilities invest in advanced infection control technologies and protocols.