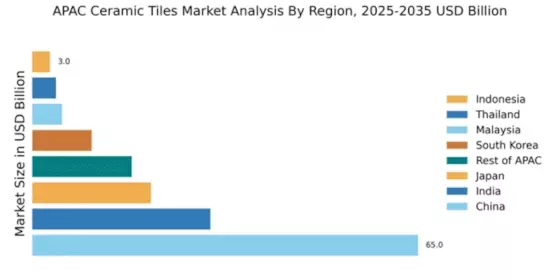

China : Unmatched Growth and Demand Trends

China holds a staggering 65.0% market share in the APAC ceramic tiles market, driven by rapid urbanization and a booming construction sector. The demand for high-quality tiles is surging, fueled by government initiatives promoting infrastructure development and housing projects. Regulatory policies favoring sustainable materials are also shaping consumption patterns, as consumers increasingly prefer eco-friendly options. The industrial landscape is evolving, with significant investments in manufacturing capabilities to meet rising demand.

India : Emerging Market with High Potential

India commands a 30.0% share of the APAC ceramic tiles market, reflecting a growing middle class and increased disposable income. The demand is driven by residential and commercial construction, with government initiatives like the Housing for All scheme boosting consumption. Regulatory support for local manufacturing is enhancing competitiveness, while the trend towards modern aesthetics is influencing consumer preferences for innovative designs and materials.

Japan : Quality and Design Over Quantity

Japan's ceramic tile market holds a 20.0% share, characterized by a preference for high-quality, aesthetically pleasing products. The market is driven by renovation projects and a focus on sustainable building practices. Government regulations promote energy-efficient materials, influencing consumer choices. The aging population is also a factor, as there is a growing demand for accessible and safe living environments, leading to increased tile usage in residential renovations.

South Korea : Trendy Tiles for Modern Spaces

With a 10.0% market share, South Korea's ceramic tile market is thriving due to a strong emphasis on design and innovation. The demand is fueled by urbanization and a vibrant real estate sector, with government policies supporting smart city initiatives. Consumers are increasingly drawn to unique designs and high-quality materials, leading to a competitive landscape where local and international players vie for market share. Major cities like Seoul and Busan are key markets driving this trend.

Malaysia : Sustainable Practices in Tile Production

Malaysia accounts for 5.0% of the APAC ceramic tiles market, with growth driven by rising construction activities and a focus on sustainable practices. Government initiatives promoting green building materials are influencing consumer preferences. The market is characterized by a mix of local and international players, with significant competition in urban areas like Kuala Lumpur. The demand for innovative designs and eco-friendly products is shaping the competitive landscape.

Thailand : Cultural Influences on Design Choices

Thailand holds a 4.0% share of the ceramic tiles market, with growth driven by a recovering economy and increased construction activities. The demand is influenced by cultural preferences for specific designs and materials, with a focus on aesthetics in residential and commercial projects. Government policies supporting infrastructure development are also contributing to market growth. Key cities like Bangkok are central to the competitive landscape, with both local and international brands present.

Indonesia : Focus on Local Manufacturing and Design

Indonesia's ceramic tile market, with a 3.0% share, is expanding due to urbanization and a growing middle class. The demand is driven by residential construction and a shift towards local manufacturing, supported by government initiatives. The competitive landscape features a mix of domestic and international players, with a focus on meeting diverse consumer needs. Major cities like Jakarta are pivotal markets, where trends towards modern designs are shaping consumption patterns.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC accounts for 16.76% of the ceramic tiles market, showcasing diverse demand trends influenced by local cultures and economic conditions. Growth is driven by urbanization and infrastructure projects across various countries. Regulatory frameworks vary, impacting market dynamics and consumer preferences. The competitive landscape includes both local and international players, with a focus on adapting to regional tastes and preferences in design and sustainability.