Increased Consumer Awareness

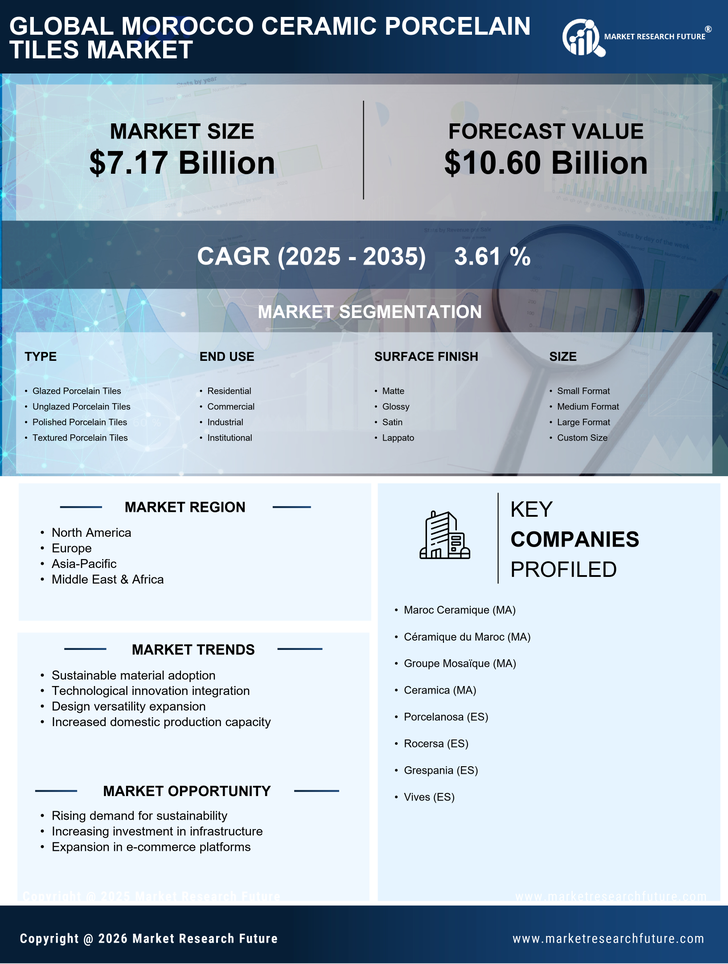

Consumer awareness regarding the benefits of ceramic porcelain tiles is on the rise, significantly impacting the Morocco Ceramic Porcelain Tiles Market. Homeowners and builders are increasingly recognizing the advantages of these tiles, such as their durability, low maintenance, and aesthetic appeal. This shift in consumer behavior is likely to drive demand, as more individuals seek out high-quality flooring options that offer both functionality and style. Market data indicates that the preference for ceramic tiles has grown by 20% in recent years, reflecting a broader trend towards sustainable and long-lasting materials. Consequently, manufacturers in the Morocco Ceramic Porcelain Tiles Market are adapting their product offerings to align with consumer preferences, emphasizing eco-friendly production methods and innovative designs.

Rising Construction Activities

The Morocco Ceramic Porcelain Tiles Market is experiencing a surge in demand due to increasing construction activities across residential, commercial, and industrial sectors. The Moroccan government has initiated various infrastructure projects, which are likely to bolster the demand for ceramic porcelain tiles. In 2025, the construction sector is projected to grow by approximately 5%, leading to a heightened need for durable and aesthetically pleasing flooring solutions. This growth is further supported by the rising disposable incomes of consumers, enabling them to invest in high-quality materials for their homes and businesses. As a result, the Morocco Ceramic Porcelain Tiles Market is poised to benefit from this upward trend in construction, with manufacturers focusing on innovative designs and sustainable practices to meet evolving consumer preferences.

Sustainability and Eco-Friendly Practices

The growing emphasis on sustainability is significantly influencing the Morocco Ceramic Porcelain Tiles Market. Consumers are increasingly seeking eco-friendly products, prompting manufacturers to adopt sustainable practices in their production processes. This includes the use of recycled materials and energy-efficient manufacturing techniques, which not only reduce environmental impact but also appeal to environmentally conscious consumers. Market Research Future indicates that the demand for sustainable ceramic tiles has increased by 30% in recent years, reflecting a broader trend towards green building materials. As a result, the Morocco Ceramic Porcelain Tiles Market is likely to see a continued shift towards sustainability, with manufacturers investing in research and development to create innovative, eco-friendly products that meet consumer expectations.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are transforming the Morocco Ceramic Porcelain Tiles Market. Innovations such as digital printing and advanced glazing techniques are enabling manufacturers to produce tiles with intricate designs and superior quality. These technologies not only enhance the aesthetic appeal of ceramic porcelain tiles but also improve their durability and resistance to wear and tear. As a result, the market is witnessing a shift towards high-performance tiles that cater to both residential and commercial applications. In 2025, it is anticipated that the adoption of these technologies will increase by 15%, further solidifying the position of ceramic porcelain tiles as a preferred choice among consumers. This trend underscores the importance of continuous innovation within the Morocco Ceramic Porcelain Tiles Market to meet the evolving demands of the market.

Urbanization and Infrastructure Development

Urbanization is a key driver of growth in the Morocco Ceramic Porcelain Tiles Market. As urban areas expand, there is a corresponding increase in the demand for housing and commercial spaces, which in turn drives the need for high-quality flooring solutions. The Moroccan government has been actively investing in infrastructure development, including roads, schools, and hospitals, which is expected to further stimulate the market. In 2025, urbanization rates are projected to reach 60%, leading to a heightened demand for ceramic porcelain tiles in both new constructions and renovations. This trend presents a significant opportunity for manufacturers in the Morocco Ceramic Porcelain Tiles Market to capitalize on the growing need for durable and stylish flooring options in urban environments.