E-commerce Expansion

The rise of e-commerce is reshaping the Asia-Pacific Commercial Real Estate Market, as businesses seek to optimize their logistics and distribution networks. With online retail sales projected to reach trillions of dollars in the coming years, demand for warehousing and distribution centers is escalating. This shift necessitates the development of modern logistics facilities that can accommodate advanced supply chain operations. Notably, countries like China and India are witnessing significant investments in logistics infrastructure, which is likely to enhance the overall commercial real estate landscape. As e-commerce continues to flourish, the implications for commercial real estate are profound, suggesting a shift in focus towards industrial properties.

Government Policies and Incentives

Government policies play a crucial role in shaping the Asia-Pacific Commercial Real Estate Market. Various countries are implementing favorable regulations and incentives to attract foreign investment and stimulate local development. For instance, tax breaks and streamlined approval processes are being introduced to encourage the construction of commercial properties. Additionally, initiatives aimed at enhancing infrastructure, such as transportation networks, are likely to bolster real estate values. As governments prioritize economic growth, the commercial real estate sector stands to benefit from these supportive measures, potentially leading to increased investment and development activity across the region.

Urbanization and Population Growth

The Asia-Pacific Commercial Real Estate Market is experiencing a surge in demand driven by rapid urbanization and population growth. As cities expand, the need for commercial spaces such as offices, retail outlets, and logistics centers intensifies. According to recent data, urban areas in Asia-Pacific are projected to house over 60% of the population by 2030, leading to increased demand for commercial real estate. This trend is particularly evident in emerging economies where a burgeoning middle class is driving consumption and investment. Consequently, developers are focusing on urban centers to capitalize on this growth, indicating a robust future for the commercial real estate sector.

Investment Trends and Capital Flows

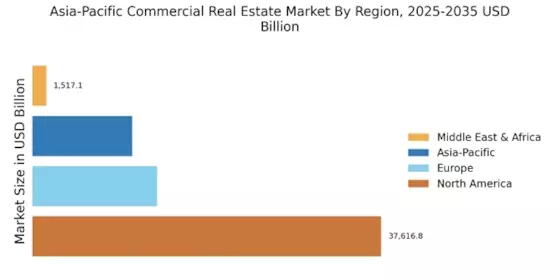

Investment trends and capital flows are pivotal in shaping the Asia-Pacific Commercial Real Estate Market. The region is witnessing a diversification of investment sources, with increased interest from institutional investors and foreign capital. Recent data indicates that Asia-Pacific has become a preferred destination for real estate investment, with billions of dollars flowing into various sectors, including office, retail, and industrial properties. This influx of capital is likely to drive competition among developers and enhance property values. Furthermore, as investors seek higher yields, there may be a shift towards alternative asset classes, such as co-working spaces and logistics facilities, indicating a dynamic investment landscape.

Technological Advancements in Real Estate

Technological advancements are significantly influencing the Asia-Pacific Commercial Real Estate Market. Innovations such as artificial intelligence, big data analytics, and smart building technologies are transforming how properties are managed and marketed. These technologies enhance operational efficiency, reduce costs, and improve tenant experiences. For example, the integration of smart building systems can lead to energy savings and increased sustainability, which are becoming essential in attracting tenants. As technology continues to evolve, it is likely to create new opportunities and challenges within the commercial real estate sector, prompting stakeholders to adapt and innovate.