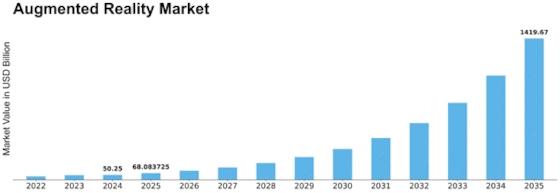

Augmented Reality Size

Augmented Reality Market Growth Projections and Opportunities

The rising use of smartphones and other smart devices is another important market aspect. Due to the devices' widespread use, augmented reality applications now have a large worldwide audience at their disposal. Due in large part to the widespread availability of AR-enabled smartphone apps that improve user experiences by providing immersive and interactive content, mobile AR in particular has experienced significant development. Numerous variables impact the Augmented Reality (AR) industry, which in turn shapes its growth trajectory. The development of technology is one important aspect.

The demand for AR technologies is rising as they develop and grow more complex. Better sensors and more potent CPUs are examples of hardware innovations that let AR fit in seamlessly with a variety of sectors, from gaming to healthcare. The competitive environment is another important factor that shapes the AR industry. The market becomes inventive and dynamic as large businesses pour money into research and development. By releasing state-of-the-art augmented reality solutions, businesses compete with one another to outdo one another, which encourages healthy growth and pushes the limits of what AR can accomplish. A crucial factor in determining the growth of the AR industry is market adoption and awareness. The need for augmented reality (AR) goods and services is growing as companies and consumers learn more about these technologies and their useful applications. Positive attitudes and increased acceptance of AR are fostered by successful AR deployments in a variety of industries, including retail, education, and healthcare.

The AR market is also impacted by regulatory concerns. Governments and regulatory agencies have a part to play in establishing rules and regulations for augmented reality technology, guaranteeing moral behavior, and resolving privacy and security issues. A favorable environment for the development and application of AR can be created by policies that are clear and encouraging. The AR market is also impacted by budgetary constraints and general economic situations. Businesses have a stronger incentive to invest in cutting-edge technology like augmented reality (AR) when the economy is expanding and stable. Economic downturns, on the other hand, can cause a brief pause in AR adoption as businesses prioritize critical spending.

Leave a Comment