Market Analysis

In-depth Analysis of Automated Storage Retrieval System Market Industry Landscape

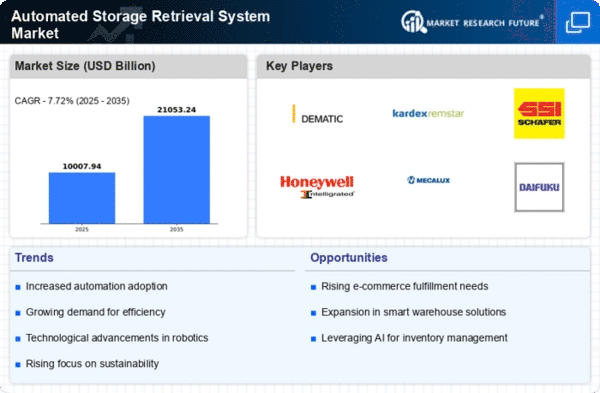

The Automated Storage and Retrieval System (ASRS) market is characterized by dynamic and evolving market dynamics driven by various factors. One key dynamic is the growing demand for automation solutions across industries. As businesses seek to optimize their warehouse operations, increase efficiency, and reduce labor costs, the adoption of ASRS systems continues to rise. These systems offer benefits such as increased storage capacity, faster retrieval times, and improved inventory accuracy, making them indispensable for modern warehouse management.

Moreover, technological advancements play a significant role in shaping the market dynamics of the ASRS industry. Innovations in robotics, artificial intelligence, and data analytics have led to the development of more advanced and efficient ASRS solutions. These technological advancements enable ASRS systems to perform complex tasks autonomously, adapt to changing operational needs, and optimize warehouse processes in real-time. As technology continues to evolve, ASRS providers must stay ahead of the curve by investing in research and development to remain competitive in the market.

Furthermore, the rise of e-commerce and omni-channel retailing has had a profound impact on the ASRS market dynamics. With the exponential growth of online shopping, businesses are under increasing pressure to fulfill orders quickly and accurately. ASRS systems play a critical role in enabling e-commerce companies to meet customer demands by automating order fulfillment processes, reducing order processing times, and minimizing errors. As the e-commerce sector continues to expand, the demand for ASRS solutions is expected to grow, driving market growth and innovation.

Additionally, globalization has led to changes in the ASRS market dynamics as companies seek to optimize their global supply chain networks. With businesses operating in multiple regions and serving customers worldwide, there is a growing need for scalable and flexible warehouse automation solutions. ASRS systems enable companies to centralize their inventory management, improve order accuracy, and reduce lead times, thereby enhancing their competitiveness in the global marketplace. As a result, ASRS providers are increasingly focused on developing solutions that can meet the diverse needs of multinational corporations and global logistics providers.

Moreover, changing consumer preferences and market trends also influence the dynamics of the ASRS market. As consumers demand faster delivery times, greater product variety, and personalized shopping experiences, businesses are under pressure to adapt their supply chain operations accordingly. ASRS systems enable companies to streamline their logistics processes, handle high order volumes, and offer flexible fulfillment options, thereby meeting the evolving needs of today's consumers. ASRS providers must stay attuned to market trends and customer preferences to develop solutions that can address these changing dynamics effectively.

Furthermore, regulatory requirements and industry standards play a significant role in shaping the dynamics of the ASRS market. Governments and regulatory bodies impose regulations related to workplace safety, data security, and environmental sustainability, which impact the design, implementation, and operation of ASRS systems. ASRS providers must ensure that their solutions comply with relevant regulations and standards to gain market acceptance and avoid potential liabilities. Additionally, industry-specific standards and certifications may influence customer preferences and purchasing decisions, further shaping the dynamics of the ASRS market.

Leave a Comment