Growing Focus on Fuel Efficiency

The Automotive Air Vent Assembly Market is also being driven by a growing focus on fuel efficiency and emissions reduction. As regulatory standards become more stringent, automotive manufacturers are compelled to develop lighter and more efficient vehicle components, including air vent assemblies. The trend towards lightweight materials, such as plastics and composites, is gaining traction, as these materials contribute to overall vehicle weight reduction. This shift not only enhances fuel efficiency but also aligns with sustainability goals. Recent studies indicate that lightweighting can improve fuel economy by up to 10%. Consequently, the Automotive Air Vent Assembly Market is likely to see increased investment in innovative materials and designs that support these objectives.

Rising Demand for Comfort Features

The Automotive Air Vent Assembly Market is experiencing a notable increase in demand for comfort features within vehicles. Consumers are increasingly prioritizing comfort and convenience, leading manufacturers to innovate and enhance air vent systems. This trend is reflected in the growing integration of advanced climate control technologies, which aim to provide optimal thermal comfort. According to recent data, the market for automotive climate control systems is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. As a result, the Automotive Air Vent Assembly Market is likely to benefit from this trend, as manufacturers strive to meet consumer expectations for enhanced comfort and personalized climate control solutions.

Expansion of Electric and Hybrid Vehicles

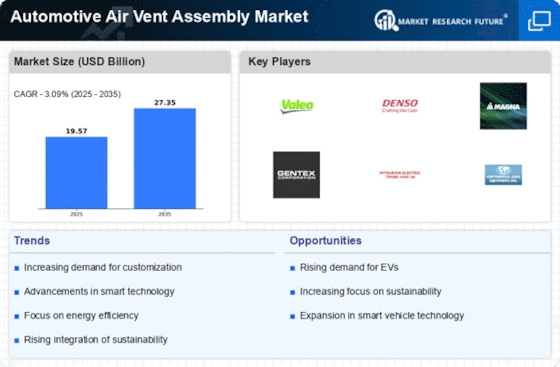

The expansion of electric and hybrid vehicles is emerging as a significant driver for the Automotive Air Vent Assembly Market. As the automotive landscape shifts towards electrification, the demand for efficient climate control systems is increasing. Electric and hybrid vehicles often require specialized air vent assemblies that can operate effectively with alternative powertrains. This transition presents opportunities for manufacturers to develop innovative solutions tailored to the unique needs of these vehicles. Furthermore, the increasing adoption of electric vehicles is projected to grow at a compound annual growth rate of over 20% in the coming years. Consequently, the Automotive Air Vent Assembly Market is poised for growth as it adapts to the evolving requirements of electric and hybrid vehicle platforms.

Technological Advancements in Manufacturing

Technological advancements are significantly influencing the Automotive Air Vent Assembly Market. Innovations in manufacturing processes, such as the adoption of automation and robotics, are enhancing production efficiency and reducing costs. These advancements enable manufacturers to produce high-quality air vent assemblies with greater precision and speed. Furthermore, the integration of computer-aided design (CAD) and simulation tools allows for more effective product development and testing. As a result, the market is witnessing a shift towards more sophisticated and reliable air vent systems. The increased efficiency in manufacturing processes is expected to drive growth in the Automotive Air Vent Assembly Market, as companies can respond more swiftly to changing consumer demands and preferences.

Consumer Preference for Enhanced Air Quality

Consumer awareness regarding air quality and its impact on health is driving changes in the Automotive Air Vent Assembly Market. There is a growing demand for air vent systems that incorporate advanced filtration technologies to improve cabin air quality. Features such as HEPA filters and air purifiers are becoming increasingly popular among consumers who prioritize health and well-being. This trend is further supported by research indicating that poor air quality can lead to various health issues. As a result, automotive manufacturers are focusing on integrating these technologies into their air vent assemblies. The Automotive Air Vent Assembly Market is likely to expand as companies innovate to meet the rising consumer expectations for cleaner and healthier in-vehicle environments.