Increasing Focus on Safety Standards

Safety regulations in the automotive sector are becoming increasingly stringent, which is influencing the Automotive Fastening and Assembly Equipment Market. Manufacturers are compelled to adopt advanced fastening solutions that meet or exceed these safety standards, particularly in areas such as crashworthiness and structural integrity. The implementation of enhanced safety features in vehicles, such as advanced driver-assistance systems (ADAS), requires robust fastening technologies that can withstand higher stress and impact forces. As a result, the demand for high-performance fastening equipment is likely to grow, prompting manufacturers to innovate and improve their product offerings to comply with evolving safety regulations.

Growth of Electric and Hybrid Vehicles

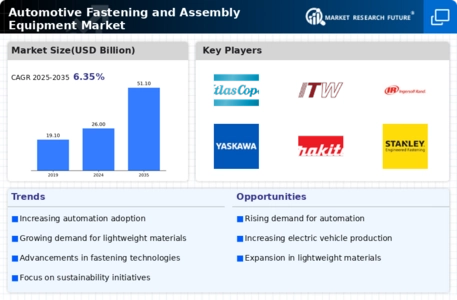

The shift towards electric and hybrid vehicles is a pivotal driver for the Automotive Fastening and Assembly Equipment Market. As automakers transition to these new vehicle types, they require specialized fastening solutions that cater to the unique assembly needs of electric drivetrains and battery systems. The market for electric vehicles is anticipated to expand rapidly, with projections indicating that electric vehicles could represent a substantial portion of total vehicle sales by 2030. This growth necessitates the development of fastening technologies that can ensure the safety and reliability of high-voltage components, thereby creating new opportunities for manufacturers of fastening and assembly equipment.

Rising Demand for Lightweight Materials

The automotive industry is increasingly adopting lightweight materials to enhance fuel efficiency and reduce emissions. This trend is driving the Automotive Fastening and Assembly Equipment Market, as manufacturers require specialized fastening solutions to work with advanced materials such as aluminum and composites. The demand for these materials is projected to grow, with estimates suggesting that lightweight vehicles could account for over 30% of the market by 2030. Consequently, fastening and assembly equipment must evolve to accommodate these changes, ensuring that they provide the necessary strength and durability while maintaining weight efficiency. This shift not only influences the design and manufacturing processes but also necessitates innovative fastening technologies that can handle the unique properties of these materials.

Technological Advancements in Fastening Solutions

Technological innovations are reshaping the Automotive Fastening and Assembly Equipment Market, with advancements in fastening technologies such as ultrasonic welding, adhesive bonding, and advanced mechanical fasteners. These innovations enhance the efficiency and reliability of assembly processes, allowing manufacturers to achieve higher production rates and improved quality control. For instance, the integration of smart technologies into fastening equipment enables real-time monitoring and data analytics, which can lead to significant reductions in assembly errors. As the automotive sector continues to embrace Industry 4.0 principles, the demand for sophisticated fastening solutions is expected to rise, potentially increasing market value significantly over the next few years.

Expansion of Automotive Production in Emerging Markets

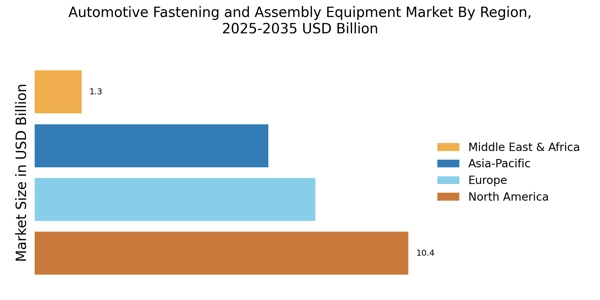

Emerging markets are witnessing a surge in automotive production, which is significantly impacting the Automotive Fastening and Assembly Equipment Market. Countries in Asia and South America are ramping up their manufacturing capabilities, driven by rising consumer demand and favorable government policies. This expansion creates a substantial need for efficient fastening and assembly solutions that can support increased production volumes. As these markets develop, local manufacturers are likely to seek advanced fastening technologies to enhance their competitiveness. Consequently, the growth of automotive production in these regions presents a lucrative opportunity for suppliers of fastening and assembly equipment, potentially leading to increased market penetration and revenue growth.