Rising Demand for Enhanced Security Features

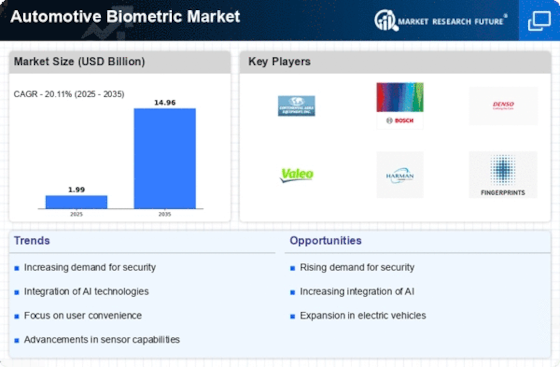

The Automotive Biometric Market is experiencing a notable surge in demand for enhanced security features. As vehicle theft and unauthorized access become increasingly prevalent, consumers are seeking advanced solutions that biometric technologies can provide. Fingerprint recognition, facial recognition, and iris scanning are among the technologies being integrated into vehicles to ensure that only authorized users can access and operate them. According to recent estimates, the biometric vehicle access segment is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates a strong consumer preference for safety and security, driving manufacturers to invest in biometric systems that can offer robust protection against theft and unauthorized use.

Regulatory Support for Biometric Implementation

Regulatory support is emerging as a significant driver for the Automotive Biometric Market. Governments and regulatory bodies are increasingly recognizing the importance of vehicle security and user safety, leading to the establishment of guidelines that encourage the adoption of biometric technologies. These regulations often mandate the implementation of advanced security measures in new vehicles, thereby creating a favorable environment for biometric solutions. As compliance with these regulations becomes essential for manufacturers, the demand for biometric systems is expected to rise. This regulatory landscape not only promotes innovation but also ensures that consumers benefit from enhanced safety features in their vehicles.

Technological Advancements in Biometric Systems

Technological advancements are playing a pivotal role in shaping the Automotive Biometric Market. Innovations in sensor technology, machine learning algorithms, and data processing capabilities are enhancing the accuracy and reliability of biometric systems. For instance, the integration of artificial intelligence with biometric recognition systems allows for real-time processing and improved user experience. As these technologies evolve, they are becoming more cost-effective, making them accessible to a broader range of automotive manufacturers. The market for biometric systems in vehicles is expected to reach several billion dollars by the end of the decade, reflecting the growing recognition of their potential to transform vehicle security and user interaction.

Consumer Preference for Personalized Experiences

The Automotive Biometric Market is increasingly influenced by consumer preference for personalized experiences. Biometric technologies enable vehicles to recognize individual users, allowing for tailored settings such as seat position, climate control, and infotainment preferences. This level of personalization enhances user satisfaction and comfort, making vehicles more appealing to consumers. As automakers strive to differentiate their offerings in a competitive market, the integration of biometric systems that cater to individual preferences is becoming a key selling point. Market Research Future indicates that vehicles equipped with biometric personalization features are likely to see higher sales, as consumers are drawn to the convenience and enhanced driving experience these technologies provide.

Growing Awareness of Vehicle Safety and Security

Growing awareness of vehicle safety and security is a crucial driver for the Automotive Biometric Market. As consumers become more informed about the risks associated with vehicle theft and unauthorized access, there is a heightened demand for advanced security solutions. Biometric technologies, which offer a higher level of security compared to traditional key systems, are increasingly being viewed as essential features in modern vehicles. Market analysts predict that the emphasis on safety will lead to a significant increase in the adoption of biometric systems, with projections indicating that the market could expand substantially over the next few years. This trend underscores the importance of integrating biometric solutions to meet consumer expectations for safety and security.