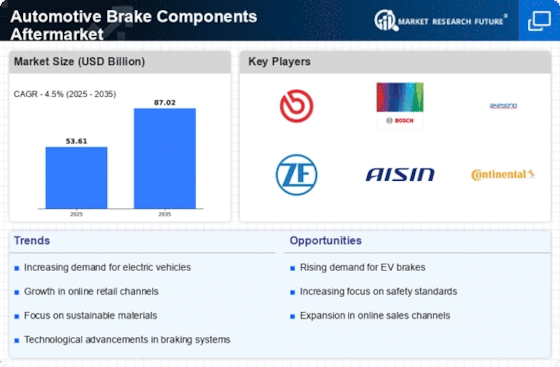

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Automotive Brake Components Aftermarket Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Automotive Brake Components Aftermarket industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Automotive Brake Components Aftermarket industry to benefit clients and increase the market sector. In recent years, the Automotive Brake Components Aftermarket industry has offered some of the most significant advantages to medicine. Major players in the Automotive Brake Components Aftermarket, including Hyundai Motor Co., Meritor Inc., Nisshinbo Holdings Inc., Robert Bosch GmbH, Disc, Brakes Australia Pty. Ltd., Carlisle Companies Inc., Continental AG, Baer Inc., BorgWarner Inc., Brembo SpA, First Brands Group, Freeman Automotive UK Ltd., Haldex AB, and Akebono Brake Industry Co., are attempting to increase market demand by investing in research and development operations. Environmental and Energy Company

Nisshinbo Holdings Inc. (Nisshinbo) creates, produces, and distributes a variety of goods. It sells electronic components, brake friction materials, brake parts, tissue, printing paper, processed paper goods, machine tools, and environmental goods. It also sells wireless communication equipment and electronic parts. Nisshinbo Holdings Inc. announced in March 2022 that it would create a joint venture firm in Gurgaon, Haryana, India, with Continental AG (Continental). The newly founded business will manufacture and market valve blocks, which are essential to electronic brake systems (EBS).

Hyundai Motor Co. is a manufacturer of automobiles. The business creates, develops, produces, and distributes automobiles, including chassis, engines, and parts, as well as cars, lorries, buses, SUVs, MPVs, and hydrogen-powered vehicles. Hyundai also offers services for processing credit cards and financing vehicles. Hyundai sells its goods under a number of different brand names, including Veloster, Venue, Azera, i40, Elantra, Tucson, Accent, Kona, Creta, Sonata, i20, and ix20. The business works to create cutting-edge technologies like Advanced Air Mobility (AAM) and robotics. It operates in Europe, Asia Pacific, North and South America, and other continents. The business has production sites in the US, Brazil, Russia, China, Korea, Turkey, India, and the Czech Republic. The headquarters of Hyundai are in Seoul, South Korea. Hyundai declared in 2022 that it would soon add ADAS safety features to its top-of-the-line Creta model in order to stay competitive.

In September 2024, ZF Aftermarket expanded its TRW brake pad coverage to 90% of the Indian vehicle market, improving availability for passenger and commercial vehicles. The expansion supports safer braking performance across a wide range of models. It solidifies ZF’s dominance in India’s braking components segment.

Recently, Uno Minda expanded its aftermarket portfolio with a new series of high-performance brake pads, engineered for improved durability and consistent braking across Indian driving conditions. The range broadens the company’s product coverage in the passenger vehicle segment.