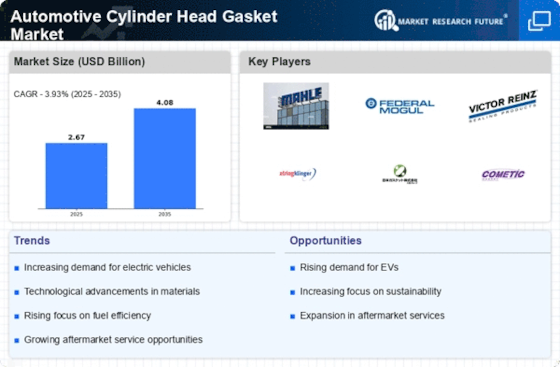

Increasing Vehicle Production

The automotive industry is witnessing a surge in vehicle production, which directly influences the Automotive Cylinder Head Gasket Market. As manufacturers ramp up production to meet consumer demand, the need for high-quality cylinder head gaskets becomes paramount. In 2025, the production of passenger cars is projected to reach approximately 80 million units, indicating a robust growth trajectory. This increase in vehicle assembly not only drives demand for cylinder head gaskets but also necessitates advancements in gasket technology to ensure durability and performance. Consequently, the Automotive Cylinder Head Gasket Market is likely to experience significant growth as manufacturers seek to enhance engine efficiency and reduce emissions, aligning with regulatory standards.

Expansion of Aftermarket Services

The aftermarket segment of the automotive industry is expanding, which presents a lucrative opportunity for the Automotive Cylinder Head Gasket Market. As vehicle owners increasingly seek to maintain and enhance their vehicles, the demand for replacement parts, including cylinder head gaskets, is on the rise. In 2025, the aftermarket for automotive parts is projected to grow at a compound annual growth rate of 4.5%, indicating a robust market for replacement gaskets. This growth is driven by the increasing age of vehicles on the road, as older models often require gasket replacements due to wear and tear. Consequently, the Automotive Cylinder Head Gasket Market is likely to benefit from this trend, as manufacturers and suppliers focus on providing high-quality replacement gaskets to meet consumer needs.

Rising Engine Performance Standards

As automotive technology evolves, there is a growing emphasis on engine performance and efficiency. The Automotive Cylinder Head Gasket Market is significantly impacted by the rising standards for engine performance, which necessitate the use of advanced gaskets. Engine manufacturers are increasingly focusing on optimizing combustion efficiency and reducing friction, leading to a demand for high-performance cylinder head gaskets. In 2025, it is estimated that the market for high-performance gaskets will account for a substantial share of the overall automotive gasket market, driven by the need for improved fuel economy and reduced emissions. This trend suggests that the Automotive Cylinder Head Gasket Market will continue to innovate, developing materials and designs that meet these stringent performance criteria.

Regulatory Compliance and Emission Standards

The automotive sector is increasingly subject to stringent regulatory compliance and emission standards, which significantly influence the Automotive Cylinder Head Gasket Market. Governments worldwide are implementing stricter regulations to reduce vehicle emissions, prompting manufacturers to develop gaskets that can withstand higher pressures and temperatures. In 2025, it is expected that compliance with these regulations will drive a 20% increase in demand for specialized cylinder head gaskets designed for low-emission vehicles. This trend indicates that the Automotive Cylinder Head Gasket Market must adapt to evolving regulatory landscapes, focusing on innovation and sustainability to meet the demands of both consumers and regulatory bodies.

Technological Innovations in Gasket Manufacturing

Technological advancements in manufacturing processes are reshaping the Automotive Cylinder Head Gasket Market. Innovations such as 3D printing and advanced material science are enabling manufacturers to produce gaskets that are lighter, stronger, and more resistant to extreme conditions. In 2025, it is anticipated that the adoption of these technologies will lead to a 15% reduction in production costs for high-performance gaskets, making them more accessible to a broader range of consumers. This shift towards innovative manufacturing techniques not only enhances product quality but also allows for greater customization to meet specific engine requirements. As a result, the Automotive Cylinder Head Gasket Market is poised for growth, driven by the demand for technologically advanced products that improve engine reliability and efficiency.

.png)