Expansion of Connectivity Features

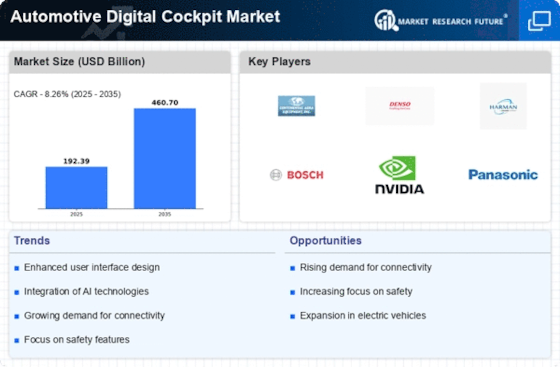

The expansion of connectivity features in vehicles is a crucial driver for the Automotive Digital Cockpit Market. With the proliferation of smartphones and IoT devices, consumers expect seamless integration between their vehicles and personal technology. Features such as smartphone connectivity, in-car Wi-Fi, and cloud-based services are becoming standard in modern vehicles. This trend is expected to continue, with forecasts suggesting that by 2026, over 70% of new vehicles will be equipped with advanced connectivity options. Consequently, the Automotive Digital Cockpit Market is poised for growth as manufacturers strive to enhance connectivity capabilities, ensuring that drivers and passengers remain connected and engaged throughout their journeys.

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Automotive Digital Cockpit Market. As consumers become more environmentally conscious, the demand for EVs has surged, leading to a corresponding need for advanced digital cockpit solutions. In 2025, it is estimated that EV sales will account for over 30% of total vehicle sales, necessitating sophisticated digital interfaces that enhance user interaction and vehicle management. These digital cockpits not only provide essential information but also integrate features such as navigation, entertainment, and vehicle diagnostics, thereby enhancing the overall driving experience. The Automotive Digital Cockpit Market is thus positioned to benefit significantly from this trend, as manufacturers seek to differentiate their EV offerings through innovative cockpit technologies.

Increased Focus on Driver and Passenger Safety

The heightened emphasis on driver and passenger safety is a significant driver for the Automotive Digital Cockpit Market. With the rise in road traffic accidents, manufacturers are prioritizing safety features in vehicle design. Digital cockpits are being equipped with advanced safety technologies, such as collision avoidance systems and real-time monitoring of driver alertness. These features not only enhance safety but also comply with stringent regulatory standards being implemented across various regions. The Automotive Digital Cockpit Market is thus experiencing a shift towards integrating safety-centric technologies, which is expected to contribute to a market growth rate of approximately 12% annually as manufacturers respond to consumer demand for safer driving environments.

Growing Consumer Preference for Personalization

Consumer preference for personalization in vehicle interiors is increasingly influencing the Automotive Digital Cockpit Market. Modern drivers seek tailored experiences that reflect their individual tastes and preferences. Digital cockpits are evolving to offer customizable interfaces, allowing users to modify display settings, choose preferred applications, and even adjust ambient lighting. This trend is particularly pronounced among younger consumers, who prioritize technology and personalization in their vehicle choices. As a result, the Automotive Digital Cockpit Market is likely to expand, with manufacturers investing in research and development to create more adaptable and user-friendly cockpit solutions that cater to diverse consumer needs.

Technological Advancements in Automotive Systems

Technological advancements in automotive systems are driving the evolution of the Automotive Digital Cockpit Market. Innovations such as artificial intelligence, machine learning, and augmented reality are being increasingly integrated into vehicle cockpits, providing enhanced functionalities and user experiences. For instance, AI-driven voice recognition systems allow for hands-free operation, while augmented reality displays can project navigation information directly onto the windshield. These advancements not only improve safety but also cater to the growing consumer expectation for high-tech features in vehicles. As a result, the Automotive Digital Cockpit Market is likely to witness substantial growth, with projections indicating a compound annual growth rate of over 15% through the next five years.