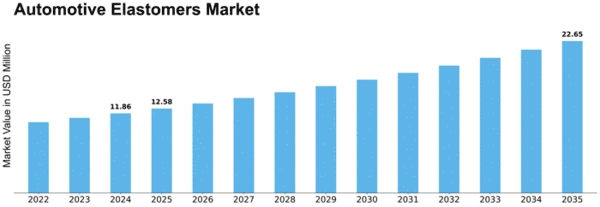

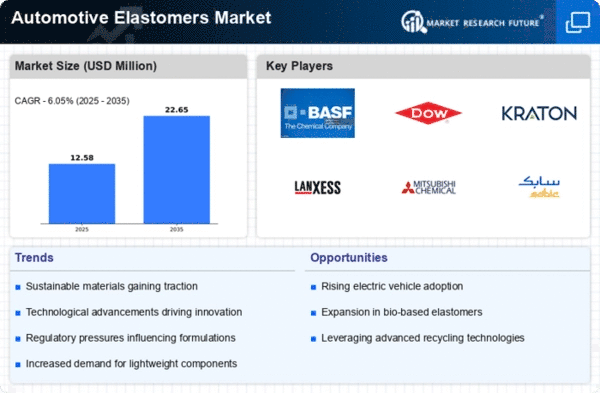

Automotive Elastomers Size

Automotive Elastomers Market Growth Projections and Opportunities

The Automotive Elastomers Market is influenced by various market factors, contributing to its growth and dynamics:

Automotive Industry Trends: Market dynamics are heavily influenced by trends within the automotive industry, including shifts towards electric and autonomous vehicles, lightweighting, and increased vehicle customization. These trends drive the demand for automotive elastomers in applications such as seals, gaskets, hoses, and vibration dampeners, as manufacturers seek materials that offer durability, flexibility, and resistance to heat and chemicals.

Stringent Emission Regulations: Regulatory standards regarding emissions and fuel efficiency drive the demand for automotive elastomers that contribute to lightweighting and improved fuel economy. Elastomers are used in engine components, exhaust systems, and fuel handling systems to reduce weight and enhance performance, aligning with emission regulations and standards in various regions.

Advancements in Material Science: Technological advancements in material science lead to the development of innovative elastomer formulations with improved properties such as heat resistance, abrasion resistance, and longevity. Manufacturers invest in research and development to introduce elastomers that meet evolving industry requirements and address emerging challenges in automotive applications, driving market growth and innovation.

Shift towards Electric Vehicles (EVs): The growing demand for electric vehicles and hybrid vehicles drives the demand for automotive elastomers used in battery pack enclosures, seals, gaskets, and insulation materials. Elastomers play a crucial role in ensuring the safety, performance, and longevity of electric vehicle components, contributing to their adoption in the automotive industry.

Globalization and Market Expansion: Market dynamics are influenced by globalization and the expansion of automotive markets into new geographical regions. Elastomer manufacturers establish strategic partnerships, distribution networks, and production facilities to meet the growing demand for automotive elastomers in emerging markets and capitalize on new growth opportunities globally.

Consumer Preferences and Market Trends: Market dynamics are responsive to shifting consumer preferences and market trends, such as increased demand for SUVs, crossovers, and luxury vehicles. Automotive elastomers are used in interior components, weather seals, and noise insulation materials to enhance comfort, aesthetics, and performance, aligning with consumer preferences and market trends in the automotive industry.

Supply Chain Dynamics: The availability of raw materials, production capacity, logistics, and distribution networks significantly impact the automotive elastomers market. Supply chain disruptions, trade policies, and geopolitical factors can influence market dynamics by affecting the availability and pricing of elastomers and their feedstocks, driving manufacturers to adapt to changing market conditions.

Market Competition and Industry Consolidation: The automotive elastomers market is characterized by intense competition among key players and ongoing industry consolidation through mergers, acquisitions, and partnerships. Market dynamics are influenced by factors such as pricing strategies, product differentiation, and market positioning, as companies strive to maintain their market share and competitive advantage in the automotive industry.

Technological Integration in Vehicles: Advancements in vehicle technology, including connectivity, autonomous driving systems, and advanced safety features, drive the demand for automotive elastomers used in electronic components, sensor housings, and wiring harnesses. Elastomers with excellent electrical insulation properties and resistance to temperature extremes are essential for ensuring the reliability and performance of modern vehicle systems.

Environmental Sustainability Initiatives: Increasing emphasis on environmental sustainability and corporate social responsibility initiatives influence market dynamics by driving demand for eco-friendly and recyclable elastomers. Manufacturers develop elastomers with reduced environmental impact, bio-based content, and recyclability to meet sustainability goals and regulatory requirements in the automotive industry.

Leave a Comment