Market Stability

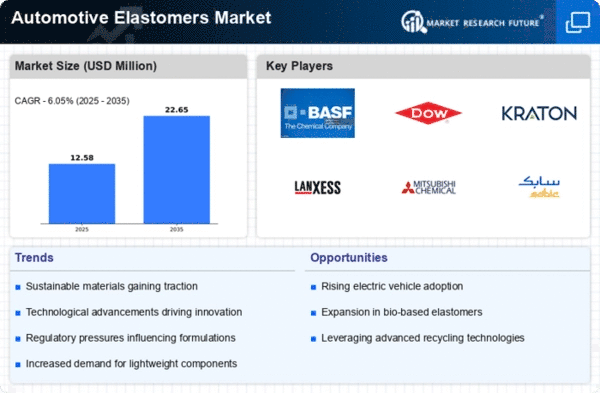

The Global Automotive Elastomers Market Industry exhibits a unique stability characterized by a projected compound annual growth rate (CAGR) of 0.0% from 2025 to 2035. This stability suggests a mature market where demand remains consistent, driven by ongoing automotive production and the need for replacement parts. Despite fluctuations in the broader economy, the automotive sector's reliance on elastomers for various applications ensures a steady market presence. This stability may attract investment and innovation, as companies seek to maintain their competitive edge in a market that is not expected to experience significant growth or decline.

Regulatory Compliance

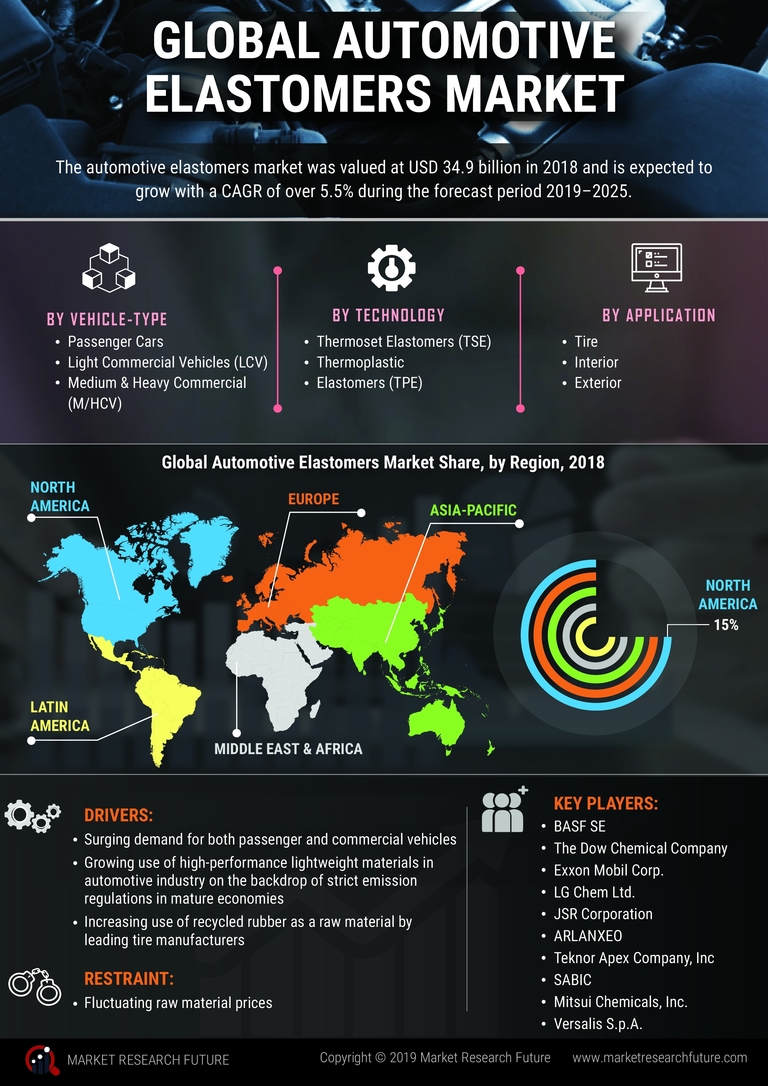

Regulatory compliance is a pivotal factor influencing the Global Automotive Elastomers Market Industry. Governments worldwide are implementing stringent regulations regarding vehicle emissions and safety standards, compelling manufacturers to adopt advanced materials that meet these requirements. Elastomers are increasingly utilized in components that contribute to noise reduction, vibration damping, and overall vehicle safety. Compliance with these regulations not only enhances vehicle performance but also ensures market competitiveness. As regulatory frameworks continue to evolve, the demand for compliant elastomer solutions is expected to grow, thereby impacting market dynamics.

Sustainability Initiatives

The Global Automotive Elastomers Market Industry is increasingly influenced by sustainability initiatives aimed at reducing environmental impact. Manufacturers are focusing on developing eco-friendly elastomers that are recyclable and derived from renewable resources. This shift not only meets regulatory requirements but also aligns with consumer preferences for sustainable products. For instance, companies are investing in bio-based elastomers, which can significantly lower carbon footprints. As the automotive sector moves towards greener technologies, the demand for sustainable elastomers is expected to rise, potentially driving market growth in the coming years.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Automotive Elastomers Market Industry. Innovations in polymer chemistry and processing techniques are leading to the development of advanced elastomers with enhanced properties such as improved durability, heat resistance, and flexibility. These advancements enable manufacturers to produce components that meet the stringent performance requirements of modern vehicles. For example, the introduction of thermoplastic elastomers has revolutionized the production of automotive parts, allowing for lighter and more efficient designs. As technology continues to evolve, it is likely to further propel the market forward.

Growing Electric Vehicle Adoption

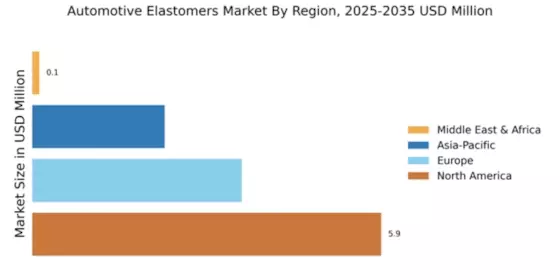

The rise of electric vehicles (EVs) is a significant driver for the Global Automotive Elastomers Market Industry. As the automotive landscape shifts towards electrification, the demand for lightweight and high-performance materials becomes paramount. Elastomers are essential in various EV components, including battery casings and seals, due to their excellent insulating properties. The market is projected to maintain a steady valuation of 45 USD Billion in 2024, with the same expected in 2035, indicating a stable demand driven by the ongoing transition to electric mobility. This trend suggests that elastomers will play a vital role in the future of automotive design.