Rising Complexity of Automotive Designs

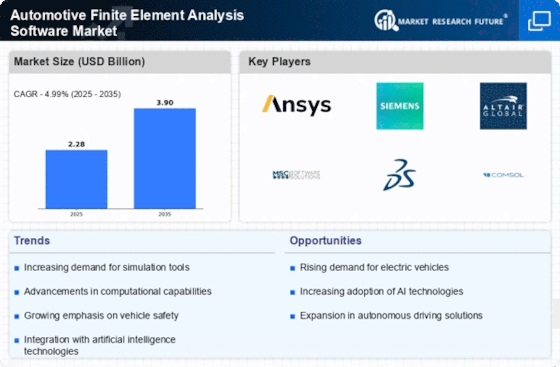

Automotive designs are becoming increasingly complex due to the integration of advanced technologies and features. This complexity is driving the Automotive Finite Element Analysis Software Market, as manufacturers require sophisticated tools to analyze and validate their designs. FEA software enables engineers to simulate various scenarios and assess the performance of intricate components, ensuring that they meet both functional and safety requirements. As vehicles incorporate more electronic systems, sensors, and connectivity features, the need for comprehensive analysis tools is likely to grow. The market for automotive design and engineering solutions is expected to expand, further fueling the demand for FEA software that can handle this complexity effectively.

Advancements in Vehicle Safety Standards

The automotive sector is increasingly focused on enhancing vehicle safety, leading to stricter safety regulations and standards. This evolution is significantly impacting the Automotive Finite Element Analysis Software Market, as manufacturers must ensure compliance with these regulations through rigorous testing and validation processes. FEA software plays a crucial role in simulating crash tests and other safety assessments, allowing engineers to identify potential weaknesses in vehicle designs. As safety standards continue to evolve, the demand for advanced FEA tools that can provide accurate simulations and analyses is likely to increase. The market for automotive safety systems is expected to grow, further driving the adoption of FEA software to meet these emerging requirements.

Emphasis on Cost Reduction and Efficiency

In a competitive automotive market, manufacturers are under constant pressure to reduce costs while maintaining high-quality standards. This emphasis on cost reduction is influencing the Automotive Finite Element Analysis Software Market, as companies seek to streamline their design and testing processes. FEA software allows for virtual testing, which can significantly decrease the time and resources required for physical prototypes. By identifying potential design flaws early in the development process, manufacturers can avoid costly rework and delays. The market for cost-effective engineering solutions is anticipated to grow, driving the adoption of FEA tools that enhance efficiency and reduce overall production costs.

Growth of Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is reshaping the automotive landscape, creating new challenges and opportunities for manufacturers. This transformation is influencing the Automotive Finite Element Analysis Software Market, as companies seek to develop innovative designs that accommodate electric drivetrains and autonomous technologies. FEA software is essential for analyzing the structural integrity and performance of these new vehicle architectures. As the market for electric vehicles is projected to expand significantly, the demand for advanced simulation tools that can optimize designs for weight, safety, and efficiency is expected to rise. This shift towards electrification and automation is likely to propel the growth of the FEA software market, as manufacturers strive to stay competitive in this evolving environment.

Increasing Demand for Lightweight Materials

The automotive industry is witnessing a pronounced shift towards lightweight materials to enhance fuel efficiency and reduce emissions. This trend is driving the Automotive Finite Element Analysis Software Market, as manufacturers require advanced simulation tools to analyze the performance of these materials under various conditions. The use of finite element analysis (FEA) allows engineers to predict how lightweight materials behave in real-world scenarios, ensuring safety and durability. As regulations tighten around emissions, the demand for software that can efficiently model and test these materials is expected to grow. In fact, the market for lightweight materials is projected to reach substantial figures, further propelling the need for sophisticated FEA tools that can accommodate these innovations.