Market Share

Introduction: Navigating the Competitive Landscape of Automotive LiDAR Sensors

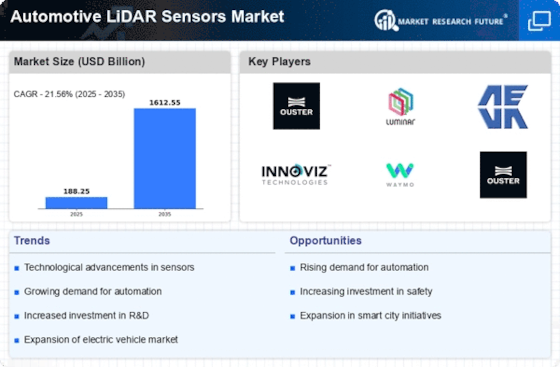

The market for the RADAR sensors for the cars is going through a great upheaval, a result of the rapid technological development, the changing regulatory framework and the increased demand for safety and automation. The leading players, including the car manufacturers, IT companies, and the most recent AI companies, are waging a fierce battle for the leadership, deploying advanced capabilities such as deep learning, real-time automation, and IoT integration. These technology-driven capabilities are not only improving the performance of the sensors but also reshaping the competition as companies compete to offer superior data accuracy and reliability. The report also notes that the market is growing in the regions, especially in North America and Asia-Pacific, where strategic deployments are influenced by government initiatives and increased investment in smart transport. In the future, the understanding of the competitive environment and the technological development of the market will be crucial for the strategic planning of the C-level managers and the strategic planners of the companies.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions integrating LiDAR technology with advanced software and hardware for automotive applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| NVIDIA | Leading AI computing platform | Autonomous vehicle systems | Global |

| Ford Motor Company | Established automotive manufacturer | Integrated vehicle systems | North America, Europe |

| Aptiv | Strong focus on safety and connectivity | Automotive electronics and software | Global |

| Continental AG | Diverse automotive technology portfolio | Vehicle safety and automation | Global |

Specialized Technology Vendors

These companies focus on developing advanced LiDAR technologies and solutions tailored for automotive applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Innoviz Technologies | High-resolution LiDAR sensors | LiDAR hardware and software | Global |

| Luminar Technologies | Long-range sensing capabilities | LiDAR sensors for autonomous vehicles | North America, Europe |

| Velodyne Lidar | Pioneering LiDAR technology | 3D LiDAR sensors | Global |

| Quanergy Systems | Solid-state LiDAR innovation | LiDAR sensors and software | Global |

| Ouster | High-performance digital LiDAR | LiDAR sensors for various applications | Global |

| LeddarTech | Sensor fusion technology | LiDAR and perception solutions | Global |

| Blickfeld | Compact and scalable LiDAR systems | LiDAR sensors for smart applications | Global |

Infrastructure & Equipment Providers

These vendors supply the necessary infrastructure and equipment to support the deployment of LiDAR technologies in automotive applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|

Autonomous Vehicle Developers

These companies are focused on developing fully autonomous vehicles, leveraging LiDAR technology for navigation and safety.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Waymo | Leader in autonomous driving technology | Self-driving vehicle systems | North America |

Automotive Component Manufacturers

These vendors integrate LiDAR technology into automotive components, enhancing vehicle safety and automation.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| DENSO | Global automotive supplier expertise | Automotive components and systems | Global |

Emerging Players & Regional Champions

- Aeva, USA, specializes in a 4D lidar technology that combines perception and motion, and has a partnership with a major carmaker to test self-driving cars. The company is competing with Velodyne by offering a more compact and cost-effective solution.

- Ouster (USA): Provides high-resolution digital lidar sensors, with a focus on scalability and cost-effectiveness. Recently it has secured contracts with several start-ups in the field of unmanned delivery. It is a strong competitor to the traditional lidar companies.

- The first is Israel's Innoviz Technologies, which is developing solid-state LiDARs for the car. The company recently announced a partnership with a major car manufacturer to produce these sensors in large quantities. Innoviz's solid-state LiDARs are a good alternative to the existing ones, because they are both technically and economically advanced.

- LeddarTech (Canada): Focuses on LiDAR technology for ADAS and autonomous vehicles, recently implemented its sensors in a fleet of autonomous shuttles, challenging established vendors by providing versatile and customizable solutions.

- AiEye (US): This company has developed a LiDAR system that can be adapted to the environment. It has teamed up with a major automobile manufacturer to integrate its LiDAR into the next generation of cars, and it is trying to compete with the traditional LiDAR.

Regional Trends: In 2024, the Automotive LiDAR Market is expected to witness significant regional growth, particularly in North America and Europe, owing to advancements in the technology of self-driving cars and the regulatory support. The companies are increasingly focusing on solid-state and hybrid LiDAR technology to meet the demand for cost-effective and reliable solutions. Also, the establishment of strategic alliances between emerging and well-established companies will help the integration of LiDAR into the production of vehicles.

Collaborations & M&A Movements

- Luminar and Volvo have entered into an agreement to integrate a Lidar system into the next generation of electric vehicles. This will enhance the safety features and the self-driving capabilities of the cars, which will strengthen their position in the market for electric vehicles.

- The two companies announced that they would be collaborating to develop the next generation of LiDAR solutions for self-driving vehicles. The goal of this collaboration is to improve the accuracy of the sensors and reduce costs. The companies hope that this will help them to increase their share in the growing field of self-driving cars.

- In a strategic move to broaden its portfolio of lidar and imaging systems, Teledyne Technologies acquired FLIR Systems, thereby strengthening its position in the growing market for sensors for driver assistance systems.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| High-Resolution Imaging | Velodyne Lidar, Luminar Technologies | The advanced 360-degree imaging technology of Velodyne Lidar is essential to the development of driverless vehicles. Luminar has made significant progress in the development of high-resolution sensors for object detection and recognition. Its relationships with the leading automobile manufacturers show that. |

| Real-Time Data Processing | Aptiv, Waymo | LiDAR sensors from Aptiv are a combination of real-time data processing and decision-making in the car. Waymo's proprietary technology enables the processing of a large amount of data in real time, thereby improving safety and efficiency in urban driving. |

| Integration with AI Systems | NVIDIA, Tesla | NVIDIA's Drive platform combines the advantages of LiDAR with those of artificial intelligence to improve the perception and navigation of self-driving cars. The same is true of the Tesla Autopilot system, which, by using artificial intelligence to interpret the LiDAR data, makes it possible to achieve full self-driving capabilities, as seen in the recent software update. |

| Cost-Effectiveness | Ouster, Innoviz Technologies | Ouster has developed a solid-state lidar that is less expensive than the usual systems and so can be used in a wider range of applications. It is being used in mass-market cars, as shown by its collaborations with car manufacturers. |

| Robustness in Various Environments | Continental AG, Valeo | In Continental AG’s LiDAR systems, which are designed to function reliably in all weather conditions, the resulting degree of safety is crucial. Valeo sensors have been extensively tested in various operating conditions and have proven their ruggedness and efficiency in practical applications. |

Conclusion: Navigating the LiDAR Landscape in 2024

In the meantime, the market for automotive lidars is characterized by intense competition and notable fragmentation, with both old and new players vying for market share. New entrants are focusing on artificial intelligence, automation, and green lidars. North America and Europe are driving the demand for advanced driver assistance systems, while Asia-Pacific is embracing lidars for self-driving cars. The key for suppliers is to position themselves strategically, to meet the varied needs of their customers. The ability to adapt and to keep innovating will be the decisive factor for market leaders.

Leave a Comment