Market Trends

Introduction

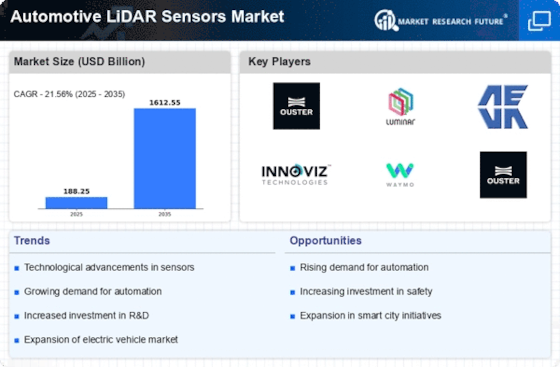

By 2024, the LiDAR market for vehicles is expected to have undergone a major transformation, thanks to a confluence of technological advances, regulatory pressures and changes in consumer behavior. The rapid evolution of the self-driving technology requires improved sensors, which in turn pushes manufacturers to develop more accurate and reliable LiDAR systems. Alongside this, governments are increasingly requiring the adoption of more advanced sensing technology to meet new safety standards. And finally, the growing demand for safer and more self-driving vehicles will also spur the development of more complex LiDAR solutions. These trends are important for those wishing to understand the complex and evolving nature of the market and to take advantage of the emerging opportunities.

Top Trends

-

Increased Adoption of Autonomous Vehicles

The market for LiDAR sensors is driven by the drive towards self-driving cars, and Waymo is at the forefront. By 2023, over half of the automakers have said they plan to integrate LiDAR into their self-driving systems. This will have a major effect on the safety and navigational capabilities of vehicles, and logistics and transport in general. -

Government Regulations and Safety Standards

Moreover, the stricter safety regulations for driverless vehicles are requiring ever more precise sensors. In Europe, for example, the LiDAR is to be mandatory for certain categories of vehicles. In this way, manufacturers are compelled to invest in LiDAR, and the market dynamics and regulatory strategies are being influenced. -

Technological Advancements in LiDAR Systems

Lidar has been gaining in importance for a long time. Recent developments, such as the solid-state design and the increase in resolution, have greatly improved its performance. Companies like Luminar have developed sensors with a range of over 250 metres, which is essential for self-driving cars. These advances will lower costs and make the technology more widely available, thus increasing its market penetration. -

Integration with AI and Machine Learning

Artificial intelligence and lidar are revolutionizing the processing and interpretation of data. Firms like Nvidia are using AI to enhance object detection and classification. The combination of lidar and artificial intelligence is expected to improve the accuracy of lidar-based systems, resulting in more reliable performance and greater trust in self-driving vehicles. -

Collaboration Between Automotive and Tech Companies

Strategic alliances between car manufacturers and technology companies are becoming increasingly common. For example, Ford has joined forces with Velodyne Lidar to further develop its on-board sensors. These collaborations are promoting innovation and accelerating the development of advanced driver assistance systems (ADAS), which are crucial to market growth. -

Cost Reduction and Accessibility of LiDAR Technology

LiDAR sensors have become cheaper as a result of improvements in manufacturing and technology. The prices have fallen by more than 30 percent in the last two years, according to some reports. This is opening up LiDAR to a wider range of vehicles, even lower-end ones, and is thus increasing the market. -

Focus on Environmental Sustainability

Among the motor vehicle industry, there is a growing interest in the development of LiDAR. Companies are experimenting with the use of sustainable materials and energy-saving designs. This is in line with the international trend towards greater sustainable development and can attract the attention of consumers who are concerned about the environment and enhance the reputation of a company. -

Emergence of New Market Entrants

The LiDAR market is seeing an influx of new entrants and start-ups, a result of technological advances and a rise in funding opportunities. For example, one company whose LiDAR solutions have attracted attention is Blickfeld. This new influx is resulting in increased competition, leading to faster development and more varied product offerings. -

Enhanced Data Security and Privacy Concerns

Concerns about data security and privacy are increasing as more and more data is collected by LIDAR systems. Leading companies are therefore prioritizing the development of secure data handling procedures. This focus is essential for gaining the trust of consumers and for ensuring compliance with data protection regulations. It also affects their market strategies. -

Global Expansion of LiDAR Applications

Beyond the automobile, LiDAR is expanding into the fields of agriculture and urban planning. Companies are exploring these new markets, and a survey shows a twenty-percent increase in cross-industry applications. This diversification is expected to lead to new revenue streams and improve the overall market outlook.

Conclusion: Navigating the Competitive LiDAR Landscape

During the forecast period, the competition in the Automotive LiDAR market will be highly fragmented, and both established and new players will be in the fray. New entrants will be able to benefit from their knowledge and relationships while established companies will be able to take advantage of their new technology and specialized applications. However, the trend of the geographical area shows that North America and Asia-Pacific are becoming more important. In these regions, the regulatory framework is favourable and technological development is progressing rapidly. The market will be dominated by companies that strategically develop their AI, automation, and sustainable and flexible capabilities. These companies will not only meet the demands of the evolving automobile landscape but will also have a competitive advantage in this dynamic market.

Leave a Comment