Automotive Lidar Sensors Size

Market Size Snapshot

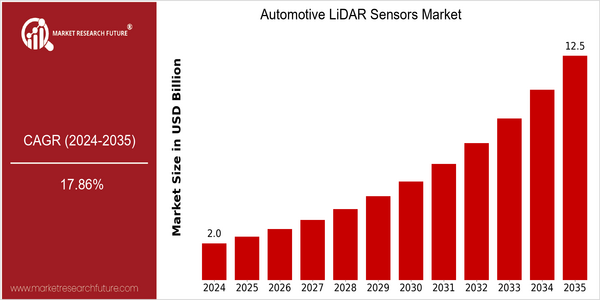

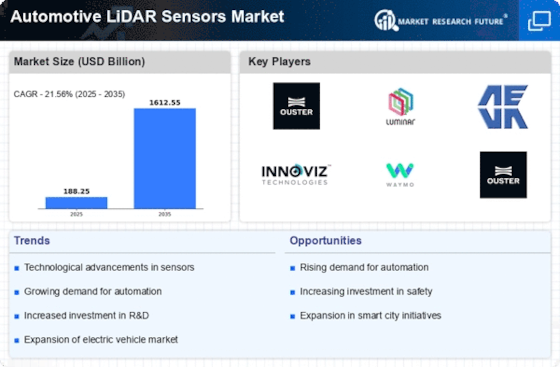

| Year | Value |

|---|---|

| 2024 | USD 2.05 Billion |

| 2035 | USD 12.5 Billion |

| CAGR (2025-2035) | 17.86 % |

Note – Market size depicts the revenue generated over the financial year

The report ‘Automotive LiDAR sensors market’ is a market research study with a forecast of the current market size estimated to be $2.05 billion in 2024, projected to reach $12.5 billion by 2035. This demonstrates a CAGR of 17.86 percent from 2024 to 2035. This strong growth indicates a strong demand for advanced sensors in the automobile sector. Autonomous vehicles are in great demand and safety and assistance systems are becoming a priority. LiDAR sensors are an important component in the perception and guidance of vehicles. The main players in the market, such as Velodyne Lidar, Luminar and Waymo, are at the forefront of innovation and are actively seeking strategic collaborations and investments. Luminar, for example, has a partnership with several large automobile manufacturers to integrate its LiDAR technology into next-generation vehicles. Velodyne, on the other hand, continues to expand its portfolio by launching new products, which are intended to optimize the performance and cost of sensors. These strategic initiatives not only highlight the competitiveness of the market, but also the potential of LiDAR technology in shaping the future of mobility.

Regional Market Size

Regional Deep Dive

Lidar sensors for automobiles are experiencing a steady growth in the market, owing to the advancements in the technology of self-driving vehicles and the increasing safety regulations. The North American market is characterized by the presence of major automobile manufacturers and technological companies, which leads to the innovation and collaboration. The European market is characterized by the development of the regulatory framework for self-driving vehicles. The Asia-Pacific region is characterized by the rapid adoption of Lidar technology in the automobile industry. The Middle East and Africa are gradually adopting this technology, influenced by economic and developmental factors. Latin America is also beginning to explore Lidar applications, especially for urban mobility.

Europe

- The European Union has implemented stringent regulations aimed at improving road safety, which has led to increased investments in LiDAR technology by automotive manufacturers such as BMW and Audi.

- Innovations in solid-state LiDAR technology are being spearheaded by companies like Valeo and Bosch, which are focusing on reducing costs and improving performance, making LiDAR more accessible for mass-market vehicles.

Asia Pacific

- China is rapidly advancing its LiDAR capabilities, with companies like Hesai Technology and RoboSense making significant strides in sensor development, driven by the country's push towards smart transportation solutions.

- The Japanese government is actively promoting autonomous vehicle testing, with initiatives that encourage collaboration between automotive manufacturers and technology firms, enhancing the integration of LiDAR systems.

Latin America

- Brazil is beginning to see interest in LiDAR technology for urban mobility projects, with local startups exploring partnerships with international firms to enhance their capabilities.

- Regulatory frameworks in Latin America are still evolving, but there is a growing recognition of the importance of advanced driver-assistance systems (ADAS), which could lead to increased demand for LiDAR sensors.

North America

- The U.S. government has initiated several programs to promote the development of autonomous vehicles, including funding for research and development in LiDAR technology, which is expected to enhance the market's growth.

- Companies like Velodyne Lidar and Luminar Technologies are leading the charge in North America, with innovative LiDAR solutions that are being integrated into various vehicle models, thereby increasing adoption rates.

Middle East And Africa

- The UAE has launched initiatives to integrate smart mobility solutions, including autonomous vehicles equipped with LiDAR, as part of its Vision 2021 strategy, which is expected to drive market growth in the region.

- Investment in infrastructure development, particularly in smart city projects in countries like Saudi Arabia, is creating opportunities for LiDAR technology adoption in urban planning and transportation.

Did You Know?

“LiDAR technology can create high-resolution 3D maps of the environment, which are crucial for the safe navigation of autonomous vehicles, and it can also be used in applications beyond automotive, such as agriculture and forestry.” — National Oceanic and Atmospheric Administration (NOAA)

Segmental Market Size

The aforementioned LiDAR sensors are a major contributor to the advancement of self-driving cars and the market is growing at a rapid pace. The main drivers are the rising demand for advanced driver-assistance systems and the stricter regulations imposed to improve road safety. Furthermore, technological developments, such as the increased accuracy and reduced cost of the sensors, are making LiDAR more accessible to car manufacturers. In terms of deployment, the market for LiDAR in cars is currently moving from the pilot phase to mass production, with Waymo and Tesla leading the way in integrating the technology into their platforms. Among the main applications are obstacle detection, mapping, and real-time environment analysis, particularly in urban environments. Besides the aforementioned drivers, other trends, such as the push towards more sustainable mobility and the government’s push for improved road safety, are also influencing the market. Also affecting the market are the solid-state LiDAR sensors and machine learning algorithms, which are enhancing the data processing and the performance of the sensors.

Future Outlook

The market for automobile lidars is expected to grow from $ 3.1 billion in 2024 to $ 9.5 billion in 2035, with a strong CAGR of 18.07%. This growth is mainly due to the increasing adoption of ADAS and the growing demand for self-driving vehicles. By 2035, the penetration rate of lidars into new car models is expected to exceed 35%, up from about 10% in 2024. Technological advances such as the development of solid-state lidars and the improvement of the resolution and range of sensors are expected to improve the performance and cost of lidars. Moreover, the establishment of a partnership between automobile manufacturers and technology companies is expected to promote the development and commercialization of lidar-equipped vehicles. Also, the integration of artificial intelligence and machine learning into the processing of lidar data will make these sensors even more useful. The market is expected to become mature, and the participants need to be flexible to take advantage of the opportunities and effectively compete in the market.

Leave a Comment