Cost Efficiency

Cost efficiency is a crucial factor driving the Automotive Polycarbonate Glazing Market. The rising costs of raw materials and production processes have prompted manufacturers to seek alternatives that offer both performance and affordability. Polycarbonate glazing presents a cost-effective solution, as it is lighter than traditional glass, leading to reduced shipping and handling costs. Moreover, the durability of polycarbonate materials minimizes replacement and maintenance expenses over the vehicle's lifecycle. Market data indicates that the adoption of polycarbonate glazing can reduce overall production costs by approximately 10%, making it an attractive option for automakers aiming to enhance profitability. Consequently, the Automotive Polycarbonate Glazing Market is likely to witness increased adoption as manufacturers strive for cost-effective solutions without compromising quality.

Regulatory Compliance

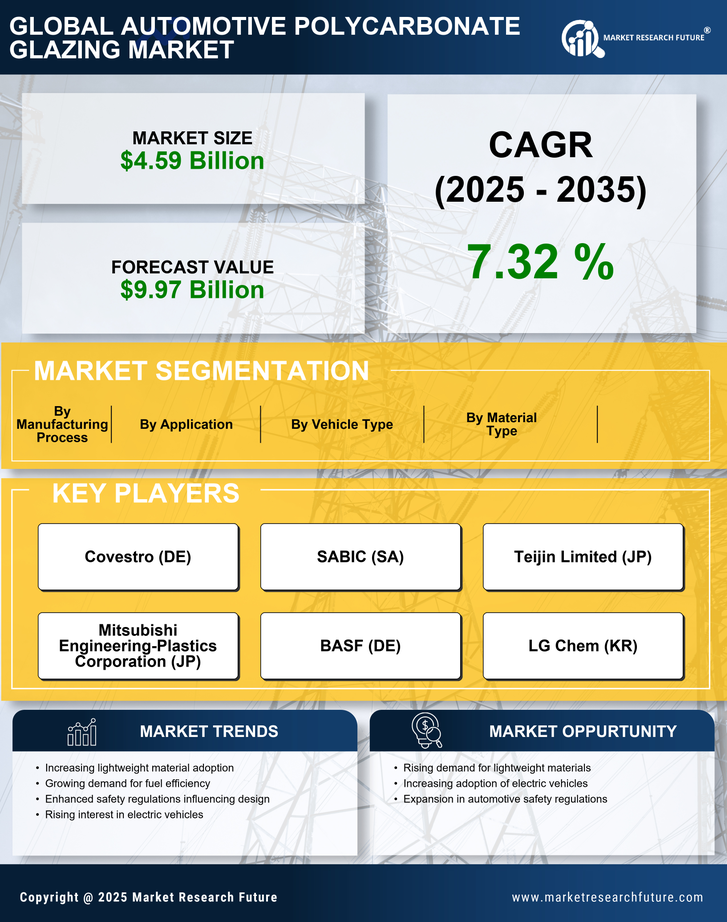

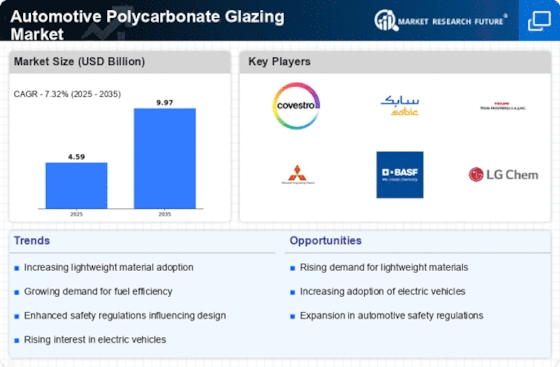

Regulatory compliance is a significant driver for the Automotive Polycarbonate Glazing Market. Governments worldwide are implementing stringent safety and environmental regulations that necessitate the use of advanced materials in vehicle manufacturing. Polycarbonate glazing meets these regulatory requirements by offering enhanced safety features, such as impact resistance and shatterproof properties. Additionally, as regulations regarding vehicle emissions become more rigorous, the lightweight nature of polycarbonate materials contributes to improved fuel efficiency, aligning with compliance goals. The Automotive Polycarbonate Glazing Market is expected to expand as manufacturers adapt to these evolving regulations, with estimates suggesting a potential market growth of 8% annually as automakers prioritize compliance in their design and production processes.

Technological Innovations

Technological innovations play a pivotal role in shaping the Automotive Polycarbonate Glazing Market. Advances in manufacturing processes, such as injection molding and advanced coating techniques, have significantly improved the performance and durability of polycarbonate materials. These innovations enable the production of glazing solutions that are not only lighter but also more resistant to scratches and UV radiation. Furthermore, the integration of smart technologies, such as embedded sensors and heating elements, is becoming increasingly prevalent. This evolution suggests that the Automotive Polycarbonate Glazing Market may experience a compound annual growth rate of over 10% in the coming years, driven by the demand for high-performance glazing solutions that enhance vehicle safety and comfort.

Sustainability Initiatives

The Automotive Polycarbonate Glazing Market is increasingly influenced by sustainability initiatives. As manufacturers and consumers alike prioritize eco-friendly practices, the demand for lightweight and recyclable materials has surged. Polycarbonate glazing, known for its lower environmental impact compared to traditional glass, aligns with these sustainability goals. In recent years, the automotive sector has seen a shift towards materials that not only reduce vehicle weight but also enhance fuel efficiency. This trend is expected to continue, with projections indicating that the use of polycarbonate materials could lead to a reduction in carbon emissions by up to 20% in certain vehicle models. Consequently, the Automotive Polycarbonate Glazing Market is poised for growth as automakers seek to meet regulatory standards and consumer expectations for greener vehicles.

Customization and Design Flexibility

Customization and design flexibility are emerging as key drivers in the Automotive Polycarbonate Glazing Market. As consumers seek personalized vehicle experiences, manufacturers are responding by offering a wider range of design options. Polycarbonate glazing allows for intricate shapes and sizes, enabling automakers to create unique vehicle aesthetics while maintaining structural integrity. This flexibility is particularly advantageous in the production of electric and autonomous vehicles, where innovative designs are essential for market differentiation. Market analysis indicates that the demand for customized automotive solutions is expected to rise, potentially increasing the share of polycarbonate glazing in vehicle production by 15% over the next five years. Thus, the Automotive Polycarbonate Glazing Market is likely to benefit from this trend towards personalization.