Automotive Radar Applications Market Summary

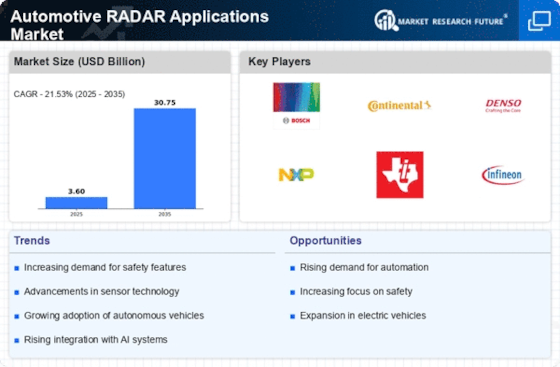

As per Market Research Future analysis, the Automotive RADAR Applications Market Size was estimated at 3.6 USD Billion in 2024. The Automotive RADAR Applications industry is projected to grow from 4.375 USD Billion in 2025 to 30.75 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 21.53% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Automotive RADAR Applications Market is poised for substantial growth driven by safety innovations and technological advancements.

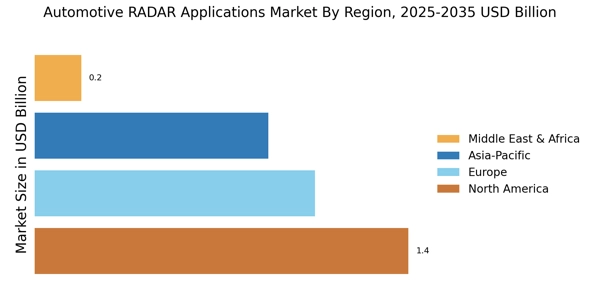

- The market exhibits an increased focus on safety features, particularly in North America, which remains the largest market.

- Growth in autonomous driving technologies is particularly pronounced in the Asia-Pacific region, recognized as the fastest-growing market.

- The 77 GHz segment dominates the market, while the 24 GHz segment is emerging rapidly due to its cost-effectiveness.

- Rising demand for advanced driver assistance systems and increasing regulatory pressure for safety standards are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 3.6 (USD Billion) |

| 2035 Market Size | 30.75 (USD Billion) |

| CAGR (2025 - 2035) | 21.53% |

Major Players

Bosch (DE), Continental (DE), Denso (JP), NXP Semiconductors (NL), Texas Instruments (US), Infineon Technologies (DE), Valeo (FR), Aptiv (IE), Hella (DE)