Top Industry Leaders in the Automotive Radar Sensors Market

Navigating the Competitive Landscape of the Automotive Radar Sensors Market

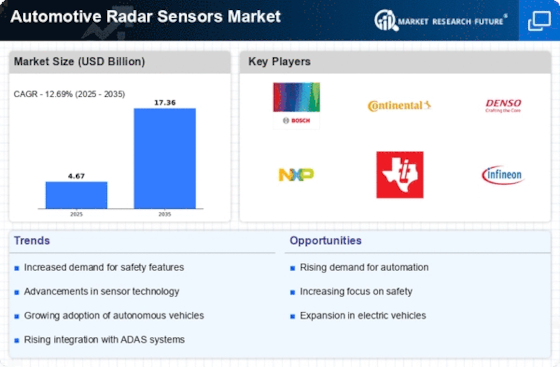

The automotive radar sensor market is poised for rapid growth, driven by the increasing demand for Advanced Driver Assistance Systems (ADAS) and the ambitious pursuit of autonomous vehicles. This surge has attracted both established players and nimble startups, creating a dynamic and fiercely competitive landscape. In order to successfully navigate this complex terrain, it is essential to understand the strategies, strengths, and weaknesses of key players in the industry.

Dominant Players and Their Strategies: Leading Tier-1 automotive suppliers such as Bosch, Continental, and Denso currently dominate the market, leveraging their deep integration with automakers and well-established production capacities. Bosch, for example, is prioritizing millimeter-wave (mmWave) radar technology for long-range applications, while Continental is focusing on software integration and sensor fusion to enhance overall performance. Denso, on the other hand, actively collaborates with startups to explore next-generation radar capabilities.

Emerging Contenders and Disruptive Potential: Challengers like Aptiv, Valeo, and Veoneer are gaining momentum with innovative sensing solutions. Aptiv is at the forefront with high-resolution radar sensors for precise object detection, while Valeo emphasizes affordability and scalability for wider market penetration. Following its acquisition by Magna International, Veoneer has positioned itself as a key player in the ADAS and autonomous driving ecosystem, leveraging expertise in software and sensor fusion.

Factors Influencing Market Share: Apart from brand recognition, several factors determine market share in this competitive landscape:

Product Portfolio: Offering a diverse range of radar sensors catering to various segments, from short-range parking sensors to long-range highway applications, is crucial.

Technological Prowess: Continuous advancements in radar technology, such as higher resolution, improved signal processing algorithms, and integration with other sensors, provide a competitive edge.

Geographical Reach: Establishing strong partnerships with automakers across diverse regions, particularly in fast-growing markets like China and India, is crucial for global market dominance.

Cost-Effectiveness: Striking a balance between advanced features and affordability is key, especially for high-volume segments like passenger cars.

New and Emerging Trends: The automotive radar sensor market is characterized by continuous innovation, with key trends including:

Fusion with Other Sensors: Integrating radar with cameras, LiDAR, and ultrasonic sensors creates a comprehensive perception of the environment, enhancing the accuracy and reliability of ADAS and autonomous driving features.

Software-Defined Radar: The ability to adjust radar functionalities through software updates enables faster innovation and adaptability to changing driving conditions.

Miniaturization and Cost Reduction: Smaller, more affordable radar sensors are opening up new applications in lower-cost vehicles and niche segments like motorcycles and commercial vehicles.

Focus on Safety and Security: Enhanced detection of vulnerable road users, coupled with cybersecurity measures to prevent sensor hacking, is becoming a top priority.

Overall Competitive Scenario: Collaboration, strategic acquisitions, and continuous innovation are crucial differentiators in this high-stakes race. Companies that prioritize affordability, expand their product offerings, and embrace leading-edge technologies are well-positioned to navigate the twists and turns of this dynamic market.

Industry Developments and Latest Updates: Recent updates from key players in the automotive radar sensors market include:

Robert Bosch GmbH (Germany): Announced a partnership with HERE Technologies to develop high-definition radar maps for improved ADAS and autonomous driving functions.

HELLA KGaA (Germany): Launched a new 77GHz short-range radar sensor with enhanced object detection and tracking capabilities for advanced parking assistance systems.

Continental AG (Germany): Unveiled a next-generation 4D imaging radar sensor with superior resolution and range for enhanced ADAS and Level 3 autonomous driving features.

Denso Corporation (Japan): Announced mass production of a new long-range radar sensor with improved detection performance for highway driving and accident prevention.

Valeo S.A (France): Showcased a prototype corner radar sensor for blind-spot detection and lane change assistance with superior performance in challenging weather conditions.

Infineon Technologies AG (Germany): Introduced a new radar chipset with advanced signal processing capabilities for improved radar sensor performance and lower cost.

Top Companies in the Automotive Radar Sensors Industry: Key players in the industry include Robert Bosch GmbH (Germany), HELLA KGaA (Germany), Continental AG (Germany), Denso Corporation (Japan), Autoliv Inc. (Sweden), Valeo S.A (France), Infineon Technologies AG (Germany), NXP Semiconductors N.V (Netherlands), and Texas Instruments Incorporated (U.S.). Other notable companies include InnoSenT - Innovative Radar Sensor Technology (Germany), First Sensor AG (Germany), Kestrel Radar Sensors (England), ZF Friedrichshafen AG (Germany), and FUJITSU TEN Ltd. (Japan), among others.