Market Analysis

In-depth Analysis of Automotive Timing Belt Market Industry Landscape

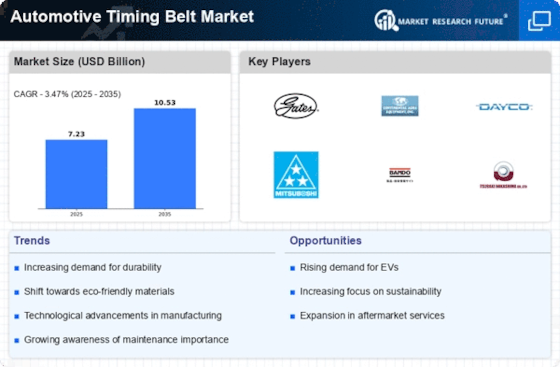

The Automotive Timing Belt Market has a lot of market factors that influence and shape its dynamics as well as its performance. One of the major drivers of this is the growth of global automotive industry owing to increasing demand for vehicles globally. Due to more people who want to own cars, efficient and reliable timing belt systems become increasingly important. In addition, the improved fuel economy focus and environmental sustainability have resulted in technologically advanced engines which further drive the need for top-notch timing belts that ensure best engine performance. Technological change is another crucial cause impacting the automotive timing belt market. Manufacturing companies in the automobile industry are always looking for ways to make their vehicles last longer and perform better, economically investing in cutting-edge technologies relating to timing belts. Advanced materials are employed, together with new methods of production used in making time belts which are not only stronger but also have less fiction and long life span when compared with old ones. The latest designs fulfil strict requirements regarding engine operation while lengthening periods between servicing thus lowering maintenance costs. Rules set by governments play a significant role in shaping the automotive timing belt market. Governments across the globe have imposed stringent emission regulations forcing manufacturers of motor vehicles to develop both powerful yet eco-friendly engines. Because of these reasons, there has been an increased demand for precise timing belts ensuring correct engine control time leading to reduced emissions rates. Market players in this area should be flexible enough to meet evolving regulatory conditions such as those required by their products. Another significant aspect that affects how car-timing belt markets work includes competition among businesses in this field is very high; therefore innovation can offer a strong competitive edge between them like no other factor does on earth today. There are many organizations involved in research producing unique highly effective systems for different types of transport using belt drives among others as one may infer from what we know already about this subject so far. Furthermore, strategic partnerships with automotive OEMs improve market penetration while promoting competitiveness in terms of quality and features as well.

Leave a Comment