Market Share

Automotive Timing Belt Market Share Analysis

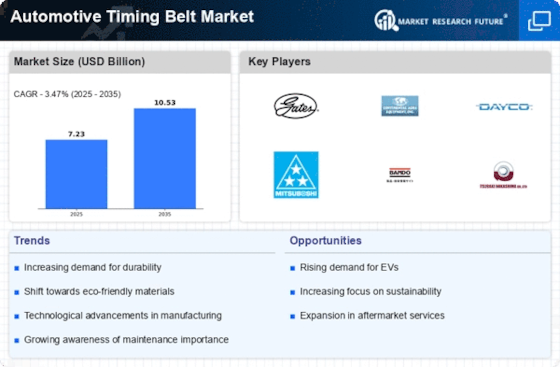

A dynamic automotive industry is responsible for several changes in the automotive timing belt market. The most remarkable trend is the desire for more sophisticated materials in manufacturing of timing belts. In car technology, there is an emerging need of materials with increased strength and reduced friction as well as improved resistance to wear and tear. Modern engines now require manufacturers to find new advanced synthetic polymers and high tensile fibers. Another important trend has been a significant increase in demand for electric and hybrid vehicles, which have direct consequences on the automotive timing belt market. Traditional internal combustion engines are increasingly being replaced by electrical powertrains hence necessitating new designs of timing belts. Electric cars mainly use alternative propulsion systems that may not need conventional timing belts. Consequently, players in the automobile engine accessory chain will have to offer products that cater to changing needs in terms of hybrid or electric vehicles. Also, fuel efficiency and emission reduction concerns have pushed engine innovations forward. This led to the development of variable valve timing (VVT) engines which enable better combustion leading to higher efficiency rates. These VVT systems need different types of timing chains able to work at any moment depending on valve’s position used in this type of motors. Accordingly, the global automotive belt market has seen a rise in demand for refreshingly new VVT compatible products indicating industries concern about ecological stability. Market trends have also been influenced by globalisation as well as interconnections between supply chains. Automotive manufacturers and suppliers are increasingly moving towards strategic alliances/collaborations so as to ensure uninterrupted supply of quality timing belts. This shift has been driven by cost effective reliable sourcing given instances such as irregular supplies due disruptions within supply chains or volatility of raw material prices. Furthermore, underused segment aftermarket sales/services are becoming an all-important feature within the automotive sector dealing with timing belts. As automobiles age with respect mileage covered; replacement of such components becomes a common procedure of maintenance. The continued increase of aftermarket timing belt sales will result in competition across the automotive market, which is a competitive market.

Leave a Comment