Rising Demand for Aftermarket Services

The Automotive Timing Belt Market is benefiting from the rising demand for aftermarket services, as vehicle owners increasingly recognize the importance of regular maintenance. Timing belts are critical components that require periodic replacement to prevent engine failure, and this awareness is driving growth in the aftermarket sector. Data indicates that a significant percentage of vehicle owners are opting for professional maintenance services, which often include timing belt inspections and replacements. This trend is further supported by the increasing age of vehicles on the road, as older models typically require more frequent maintenance. As a result, aftermarket service providers are likely to expand their offerings to include high-quality timing belts, catering to the needs of consumers seeking reliability and performance. This growing focus on maintenance and service in the Automotive Timing Belt Market suggests a promising future for aftermarket sales.

Growing Automotive Production and Sales

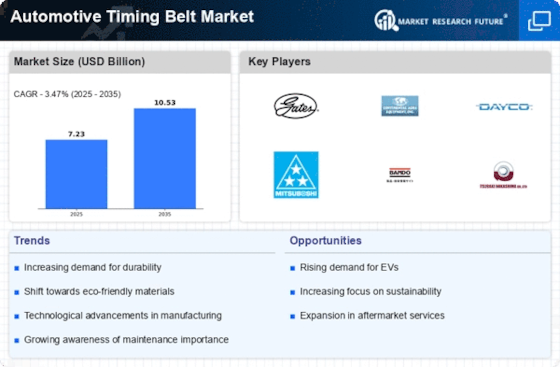

The Automotive Timing Belt Market is poised for growth, driven by the increasing production and sales of vehicles worldwide. According to recent data, the automotive sector has seen a steady rise in vehicle manufacturing, with millions of units produced annually. This growth is particularly evident in emerging markets, where rising disposable incomes and urbanization are fueling demand for personal vehicles. As more vehicles are produced, the need for reliable components, including timing belts, becomes paramount. Manufacturers are likely to focus on quality and performance, leading to an uptick in the adoption of advanced timing belt technologies. Additionally, the trend towards more complex engine designs necessitates the use of high-quality timing belts, further propelling the Automotive Timing Belt Market. This correlation between vehicle production and timing belt demand suggests a robust market outlook.

Regulatory Standards and Emission Norms

The Automotive Timing Belt Market is significantly influenced by stringent regulatory standards and emission norms imposed by governments worldwide. These regulations aim to reduce vehicle emissions and enhance fuel efficiency, prompting manufacturers to innovate and improve engine performance. As a result, there is a growing emphasis on the development of timing belts that can withstand higher temperatures and pressures, ensuring optimal engine operation. Compliance with these regulations often requires the use of advanced materials and designs in timing belts, which can lead to increased costs but also improved performance. The push for greener technologies and sustainable practices in the automotive sector is likely to drive demand for high-quality timing belts that meet these evolving standards. Consequently, the Automotive Timing Belt Market may witness a shift towards more eco-friendly and efficient products.

Expansion of Electric and Hybrid Vehicle Segments

The Automotive Timing Belt Market is witnessing a transformation due to the expansion of electric and hybrid vehicle segments. While traditional internal combustion engines have long relied on timing belts for optimal performance, the rise of electric vehicles (EVs) and hybrids presents both challenges and opportunities. Although some electric vehicles may not utilize timing belts, the hybrid segment still requires them for their combustion engines. This shift is likely to lead to a diversification of products within the Automotive Timing Belt Market, as manufacturers adapt to the changing landscape. Additionally, the integration of timing belts in hybrid systems may necessitate the development of specialized belts that can handle unique operational demands. As the automotive industry continues to evolve, the timing belt market may see innovations tailored to meet the requirements of these new vehicle types.

Technological Advancements in Automotive Timing Belts

The Automotive Timing Belt Market is experiencing a surge in technological advancements, which are enhancing the performance and durability of timing belts. Innovations such as the development of high-performance materials, including reinforced rubber and composite materials, are contributing to longer service life and improved efficiency. For instance, the introduction of timing belts with advanced tooth designs allows for better synchronization of engine components, thereby reducing wear and tear. This trend is likely to drive demand as manufacturers seek to improve vehicle reliability and performance. Furthermore, the integration of smart technologies in automotive components may lead to the development of timing belts that can monitor their own condition, providing real-time data to vehicle owners. Such advancements could potentially reshape consumer expectations and preferences in the Automotive Timing Belt Market.

Leave a Comment