Automotive Tire Market Segmentation

Global Automotive Tire Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Global Automotive Tire Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Global Automotive Tire Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Global Automotive Tire Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Global Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

o Hatchback

o Sedan

o SUVs

o MPVs

o Others

• Commercial Vehicle

o LCVs

Pickup

Vans

o Trucks

Medium-Duty Trucks

Heavy-Duty Trucks

o Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

o Agricultural Vehicles

Tractors

Combine Harvester

Sprayers

UTV

ATV

Others

o Industrial Vehicles

Forklifts

Tow Tractors

Container Handlers

Others

o Construction & Mining Vehicles

Bulldozers

Excavators

Telehandler

Wheel Loaders

• Others

Global Automotive Tire Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Global Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

o Online

o Offline/Retail

Independent Tire Dealers

Tire Company Stores

Others

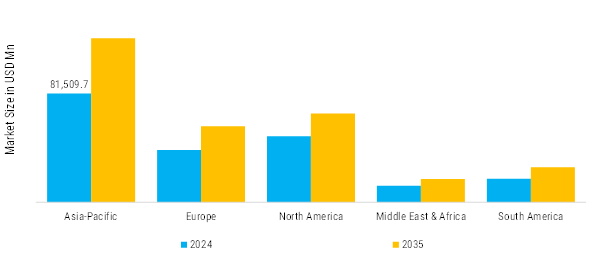

Global Automotive Tire Regional Outlook (USD Million, 2019-2032)

North America Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

North America Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

North America Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

North America Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

North America Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

North America Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

North America Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

US Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

US Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

US Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

US Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

US Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

US Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

US Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Canada Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Canada Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Canada Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Canada Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Canada Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Canada Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Canada Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Europe Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Europe Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Europe Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Europe Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Europe Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Europe Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Europe Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Germany Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Germany Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Germany Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Germany Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Germany Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Germany Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Germany Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

UK Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

UK Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

UK Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

UK Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

UK Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

UK Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

UK Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

France Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

France Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

France Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

France Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

France Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

France Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

France Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Russia Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Russia Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Russia Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Russia Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Russia Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Russia Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Russia Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Italy Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Italy Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Italy Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Italy Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Italy Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Italy Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Italy Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Spain Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Spain Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Spain Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Spain Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Spain Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Spain Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Spain Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Rest of Europe Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Rest of Europe Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Rest of Europe Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Rest of Europe Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Rest of Europe Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Rest of Europe Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Rest of Europe Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Asia-Pacific Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Asia-Pacific Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Asia-Pacific Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Asia-Pacific Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Asia-Pacific Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Asia-Pacific Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Asia-Pacific Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

China Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

China Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

China Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

China Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

China Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

China Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

China Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

India Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

India Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

India Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

India Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

India Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

India Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

India Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Japan Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Japan Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Japan Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Japan Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Japan Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Japan Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Japan Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Australia Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Australia Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Australia Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Australia Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Australia Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Australia Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Australia Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Rest of Asia Pacific Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Rest of Asia Pacific Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Rest of Asia Pacific Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Rest of Asia Pacific Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Rest of Asia Pacific Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Rest of Asia Pacific Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Rest of Asia Pacific Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

South and Central America Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

South and Central America Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

South and Central America Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

South and Central America Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

South and Central America Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

South and Central America Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

South and Central America Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Brazil Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Brazil Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Brazil Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Brazil Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Brazil Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Brazil Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Brazil Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Argentina Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Argentina Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Argentina Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Argentina Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Argentina Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Argentina Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Argentina Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Rest of South and Central America Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Rest of South and Central America Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Rest of South and Central America Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Rest of South and Central America Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Rest of South and Central America Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Rest of South and Central America Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Rest of South and Central America Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Middle East and Africa Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Middle East and Africa Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Middle East and Africa Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Middle East and Africa Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Middle East and Africa Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Middle East and Africa Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Middle East and Africa Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Saudi Arabia Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Saudi Arabia Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Saudi Arabia Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Saudi Arabia Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Saudi Arabia Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Saudi Arabia Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Saudi Arabia Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

UAE Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

UAE Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

UAE Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

UAE Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

UAE Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

UAE Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

UAE Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

South Africa Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

South Africa Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

South Africa Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

South Africa Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

South Africa Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

South Africa Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

South Africa Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Rest of Middle East and Africa Automotive Tire Market Season Type Outlook (USD Million, 2019-2032)

• Summer

• Winter

• All Season

Rest of Middle East and Africa Automotive Tire Market Type Outlook (USD Million, 2019-2032)

• Radial

• Bias

Rest of Middle East and Africa Automotive Tire Market Rim Size Outlook (USD Million, 2019-2032)

• Less than 15 Inches

• 15 to 20 Inches

• More than 20 Inches

Rest of Middle East and Africa Automotive Tire Market Application Outlook (USD Million, 2019-2032)

• On the Road

• Off the Road

Rest of Middle East and Africa Automotive Tire Market Vehicle Propulsion Outlook (USD Million, 2019-2032)

• ICE

• Electric

Rest of Middle East and Africa Automotive Tire Vehicle Type Outlook (USD Million, 2019-2032)

• Passenger Vehicle

- Hatchback

- Sedan

- SUVs

- MPVs

- Others

• Commercial Vehicle

- LCVs

- Pickup

- Vans

- Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Buses & Coaches

• 2/3 Wheeler

• Off-Highway Vehicles

- Agricultural Vehicles

- Tractors

- Combine Harvester

- Sprayers

- UTV

- ATV

- Others

- Industrial Vehicles

- Forklifts

- Tow Tractors

- Container Handlers

- Others

- Construction & Mining Vehicles

- Bulldozers

- Excavators

- Telehandler

- Wheel Loaders

• Others

Rest of Middle East and Africa Automotive Tire End Use Outlook (USD Million, 2019-2032)

• OEM

• Replacement

- Online

- Offline/Retail

- Independent Tire Dealers

- Tire Company Stores

- Others

Leave a Comment