Increased Demand for Real-Time Analytics

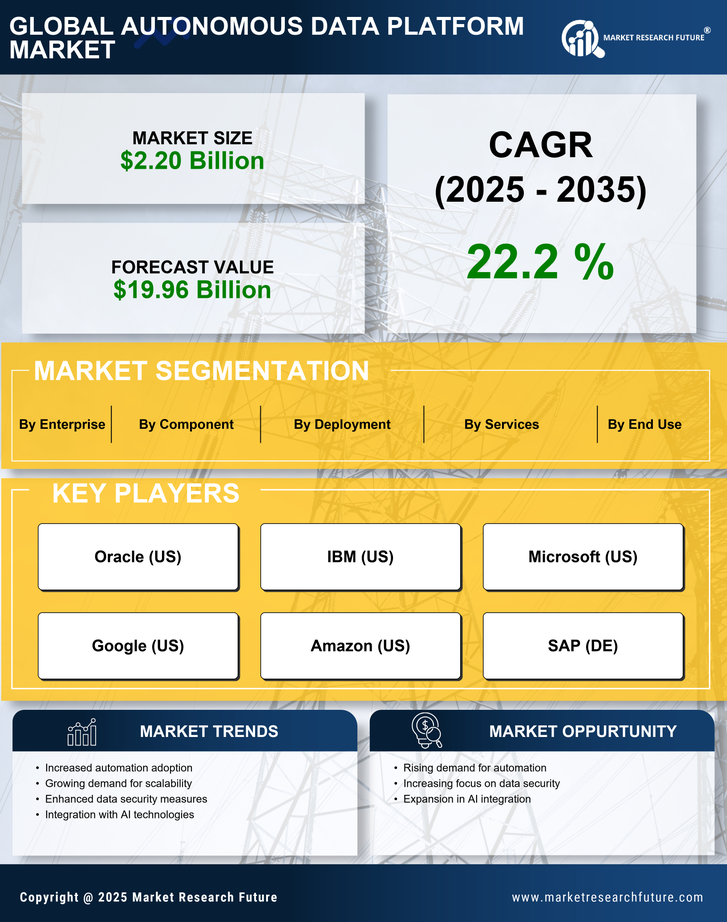

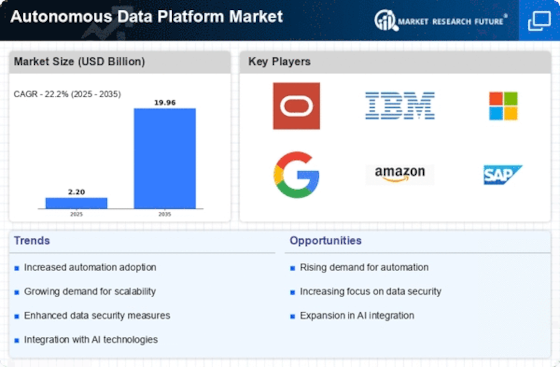

The Autonomous Data Platform Market is experiencing a surge in demand for real-time analytics, driven by the need for organizations to make data-driven decisions swiftly. As businesses increasingly rely on data to inform their strategies, the ability to analyze data in real-time becomes paramount. According to recent estimates, the market for real-time analytics is projected to grow at a compound annual growth rate of over 30% in the coming years. This trend indicates that organizations are prioritizing platforms that can provide immediate insights, thereby enhancing operational efficiency and competitive advantage. Consequently, the Autonomous Data Platform Market is adapting to meet these needs, offering solutions that facilitate rapid data processing and analysis.

Need for Enhanced Data Security Measures

The growing concern over data security is a critical driver in the Autonomous Data Platform Market. With the rise in cyber threats and data breaches, organizations are prioritizing the implementation of advanced security measures to protect sensitive information. The Autonomous Data Platform Market is projected to exceed 300 billion dollars by 2025, reflecting the increasing investment in security technologies. This heightened focus on security compels data platform providers to enhance their offerings, ensuring that autonomous data platforms incorporate robust security features such as encryption, access controls, and threat detection. Consequently, the Autonomous Data Platform Market is evolving to meet these security demands, providing solutions that safeguard data integrity and confidentiality.

Growing Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is a pivotal driver in the Autonomous Data Platform Market. Organizations are increasingly migrating their data operations to the cloud to leverage its scalability, flexibility, and cost-effectiveness. Reports suggest that the cloud computing market is expected to reach a valuation of over 800 billion dollars by 2025, highlighting the significant investment in cloud technologies. This transition allows businesses to utilize autonomous data platforms that can seamlessly integrate with existing cloud infrastructures, thereby enhancing data accessibility and collaboration. As a result, the Autonomous Data Platform Market is witnessing a transformation, with more companies opting for cloud-native solutions that support their data management needs.

Emphasis on Data Governance and Compliance

In the Autonomous Data Platform Market, there is an increasing emphasis on data governance and compliance. As regulatory frameworks become more stringent, organizations are compelled to adopt robust data management practices to ensure compliance with laws such as GDPR and CCPA. This focus on governance not only mitigates risks associated with data breaches but also enhances trust among stakeholders. The market for data governance solutions is projected to grow significantly, indicating that businesses are prioritizing platforms that offer comprehensive compliance features. Consequently, the Autonomous Data Platform Market is evolving to provide tools that facilitate effective data governance, ensuring that organizations can manage their data responsibly and transparently.

Rise of Machine Learning and AI Integration

The integration of machine learning and artificial intelligence into data platforms is a transformative driver within the Autonomous Data Platform Market. Organizations are increasingly leveraging these technologies to automate data processing, enhance predictive analytics, and improve decision-making. The market for AI in data management is anticipated to grow substantially, with estimates suggesting a potential increase of over 40% in the next few years. This integration allows for more sophisticated data analysis and insights, enabling businesses to respond proactively to market changes. As a result, the Autonomous Data Platform Market is adapting to incorporate advanced AI capabilities, positioning itself as a leader in innovative data solutions.