Growing Awareness of Aviation Safety

The Aviation Obstruction Lights Market is benefiting from a growing awareness of aviation safety among stakeholders, including government agencies, construction companies, and aviation operators. This heightened awareness is leading to increased investments in safety measures, particularly in urban areas where tall structures are prevalent. As cities expand and new skyscrapers are constructed, the need for effective obstruction lighting becomes paramount. This trend is underscored by a projected increase in the number of commercial flights, which is expected to double by 2035. Consequently, the demand for aviation obstruction lights is anticipated to rise, as stakeholders prioritize safety and compliance in their operations.

Regulatory Compliance and Safety Standards

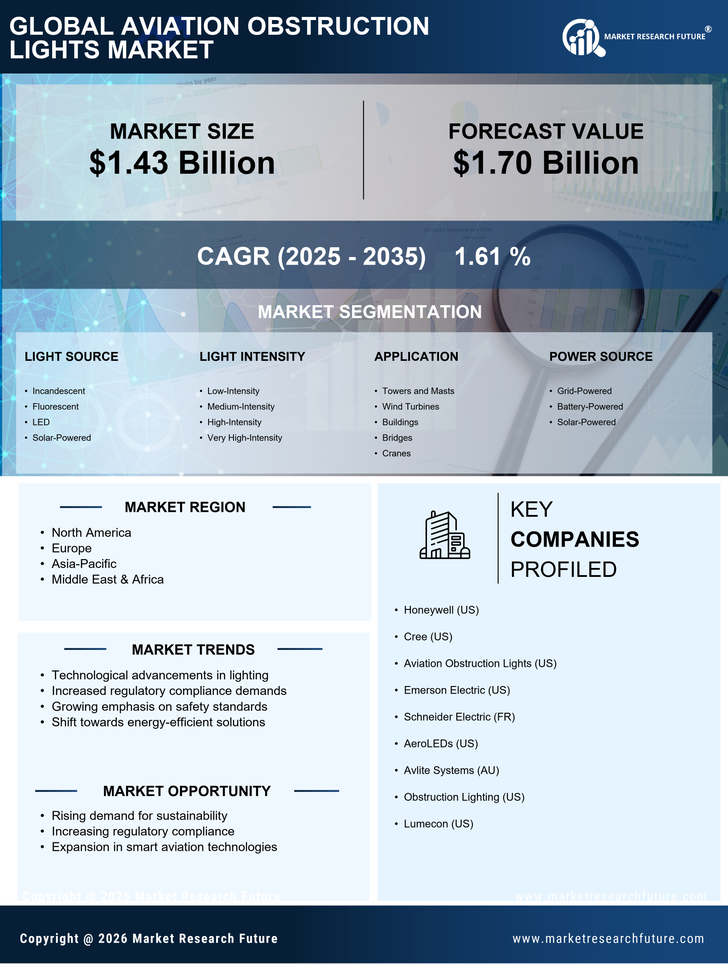

The Aviation Obstruction Lights Market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations mandate the installation of obstruction lights on tall structures to ensure the safety of aircraft during takeoff and landing. Compliance with these regulations is not only a legal requirement but also a critical factor in preventing accidents. As countries continue to enhance their aviation safety protocols, the demand for reliable and compliant obstruction lighting systems is expected to rise. This trend is reflected in the increasing investments in aviation infrastructure, which are projected to reach USD 100 billion by 2026, further propelling the market for aviation obstruction lights.

Urbanization and Infrastructure Development

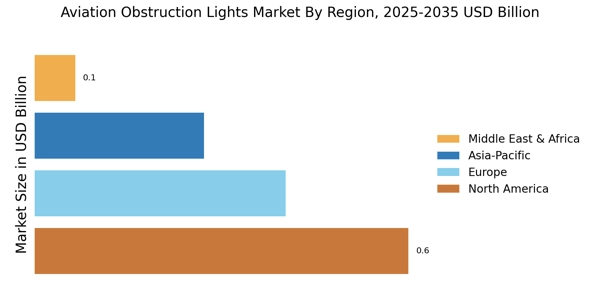

The Aviation Obstruction Lights Market is poised for growth due to rapid urbanization and infrastructure development across various regions. As urban areas expand, the construction of high-rise buildings and communication towers becomes more common, necessitating the installation of obstruction lights to ensure aviation safety. This trend is particularly evident in emerging economies, where urban populations are surging. According to recent estimates, urbanization rates are expected to reach 68% by 2050, driving the demand for aviation obstruction lights. Additionally, government initiatives aimed at improving infrastructure are likely to further stimulate market growth, as new projects will require compliance with aviation safety regulations.

Increased Investment in Aviation Infrastructure

The Aviation Obstruction Lights Market is experiencing a surge in demand due to increased investment in aviation infrastructure. Governments and private entities are allocating substantial resources to enhance airport facilities and air traffic management systems. This investment is crucial for accommodating the anticipated growth in air travel, which is projected to increase by 4.5% annually over the next decade. As airports expand and new facilities are constructed, the need for effective obstruction lighting systems becomes more pronounced. This trend is further supported by the rising number of international flights and the expansion of air travel networks, which necessitate stringent safety measures, including the installation of aviation obstruction lights.

Technological Advancements in Lighting Solutions

The Aviation Obstruction Lights Market is experiencing a notable transformation due to rapid technological advancements. Innovations in LED technology have led to the development of more energy-efficient and longer-lasting lighting solutions. These advancements not only enhance visibility but also reduce maintenance costs, which is crucial for operators managing multiple aviation facilities. Furthermore, the integration of smart technologies, such as remote monitoring and control systems, is becoming increasingly prevalent. This allows for real-time performance tracking and predictive maintenance, thereby improving operational efficiency. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, driven by these technological improvements.