Beverage Cans Size

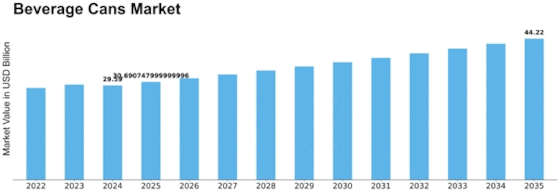

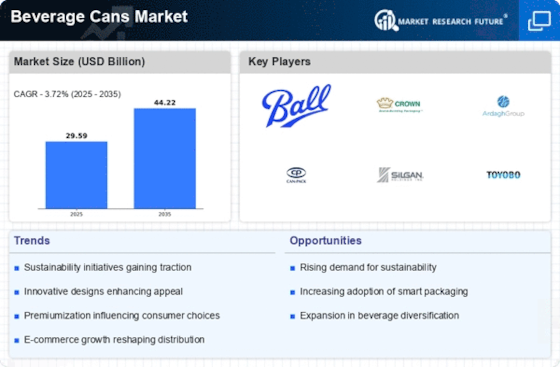

Beverage Cans Market Growth Projections and Opportunities

The beverage cans market is influenced by many market factors that make it dynamic. The main driving force behind this industry is the need for sustainable and convenient packaging solutions. With increased awareness about environmental issues, consumers have discovered beverage cans as a recyclable and sustainable alternative to traditional packaging. Furthermore, another major factor impacting the market includes the increasing consumption of ready-to-drink beverages. A busy lifestyle and a preference for on-the-go products have made beverage cans attractive to both producers and customers. Their popularity has been enhanced by the ability of these cans to keep drinks fresh and good for drinking with portability. Economic factors play an important role in shaping the beverage cans market. Changes in prices of raw materials like aluminum would directly affect production costs. In addition, changes in prices may dictate how manufacturers price their products across the entire market. Packaging technology innovation is another important driver in this market. Advancements in design, materials, and manufacturing processes contribute towards product differentiation, which drives the demand curve upwards for this product category by addressing evolving consumer preferences. Government rules coupled with environmental policies are among the issues affecting the beverage can industry landscape. Strict regulations against single-use plastics have led to various forms of eco-friendly packaging options, and beverage cans have become one of them as they recycle well after use. Recycling initiatives, as well as government awareness campaigns, are also responsible for the massive adoption of these containers since they are recyclable and environmentally friendly. Factors such as mergers, acquisitions, and partnerships affect competitive dynamics within markets. The companies involved in merger activities or partnership arrangements aim to strengthen their positions in markets, which will enhance their sales volume. This results in the continued introduction of innovative products, thus maintaining a strong brand presence. Competitive dynamics within markets involve certain business operations such as negotiations, collaborations, mergers, and acquisitions that are aimed at helping firms gain huge revenue shares. Therefore, the most significant concept behind competition is entrants strategies that are based on product development and improvement. Market globalization and shift in cultural values also affect the beverage cans market. For example, there is a rising trend of healthy eating and living, which in turn has made people shift to natural juices or functional drinks. This change determines the specific kinds of drinks put in cans, thus driving the market to healthier and more diversified products.

Leave a Comment