Increased Focus on Outdoor Activities

The jerry cans market is benefiting from an increased focus on outdoor activities and recreational pursuits. As more individuals engage in camping, hiking, and other outdoor adventures, the demand for reliable fuel storage solutions is on the rise. This trend is particularly pronounced among millennials and younger generations, who prioritize experiences over material possessions. The jerry cans market is likely to capitalize on this growing interest by offering products that cater to outdoor enthusiasts, such as lightweight and portable designs. Additionally, the rise of eco-tourism and sustainable travel practices may further drive demand for environmentally friendly jerry cans. As outdoor activities continue to gain popularity, the jerry cans market is expected to experience sustained growth.

Growth in E-commerce and Online Retail

The jerry cans market is witnessing a transformation due to the rapid growth of e-commerce and online retail platforms. Consumers are increasingly turning to online shopping for convenience and accessibility, which has led to a surge in demand for jerry cans sold through these channels. In 2025, online retail sales in the US are projected to account for over 20% of total retail sales, indicating a shift in consumer purchasing behavior. This trend presents a significant opportunity for the jerry cans market, as manufacturers and retailers can reach a broader audience. Additionally, the ability to offer detailed product information and customer reviews online enhances consumer confidence in purchasing decisions. As e-commerce continues to expand, the jerry cans market is likely to benefit from increased visibility and sales.

Rising Demand for Portable Fuel Storage

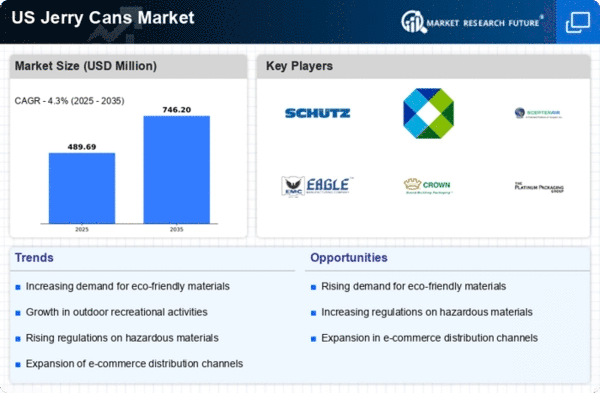

The jerry cans market is experiencing a notable increase in demand for portable fuel storage solutions. This trend is driven by the growing need for efficient fuel management in various sectors, including automotive, agriculture, and construction. As consumers and businesses seek reliable methods to store and transport fuels, the jerry cans market is projected to grow at a CAGR of approximately 5.2% over the next five years. The convenience and durability of jerry cans make them an attractive option for both personal and commercial use. Furthermore, the increasing number of outdoor recreational activities, such as camping and boating, further fuels the demand for portable fuel storage solutions. This rising demand is likely to bolster the jerry cans market, as manufacturers adapt to meet the evolving needs of consumers.

Regulatory Compliance and Safety Standards

The jerry cans market is significantly influenced by stringent regulatory compliance and safety standards imposed by government agencies. These regulations are designed to ensure safe storage and transportation of hazardous materials, including fuels and chemicals. Compliance with these standards is crucial for manufacturers, as non-compliance can lead to severe penalties and product recalls. The jerry cans market is thus compelled to innovate and enhance product designs to meet these safety requirements. For instance, the introduction of child-resistant closures and anti-spill features has become increasingly common. As safety regulations continue to evolve, the jerry cans market is expected to adapt, potentially leading to increased production costs but also higher consumer trust and market growth.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are playing a pivotal role in shaping the jerry cans market. Innovations such as injection molding and blow molding have improved production efficiency and product quality. These technologies enable manufacturers to produce jerry cans that are not only more durable but also lighter and easier to handle. The jerry cans market is likely to see a shift towards more sustainable materials, such as recycled plastics, as manufacturers seek to reduce their environmental footprint. Furthermore, automation in production lines is expected to enhance productivity and reduce labor costs. As these technological advancements continue to evolve, they may lead to a more competitive landscape within the jerry cans market, driving innovation and potentially lowering prices for consumers.