Advancements in Sensor Technologies

Advancements in sensor technologies are playing a pivotal role in the Big Data In Oil And Gas Market. The proliferation of IoT devices and sensors enables the collection of real-time data from various stages of oil and gas operations, including drilling, production, and transportation. This influx of data provides valuable insights that can be analyzed to optimize performance and enhance safety measures. As of 2025, it is anticipated that the integration of advanced sensors will contribute to a market growth rate of approximately 12%, as companies seek to leverage real-time data for improved decision-making and operational excellence.

Enhanced Data Analytics Capabilities

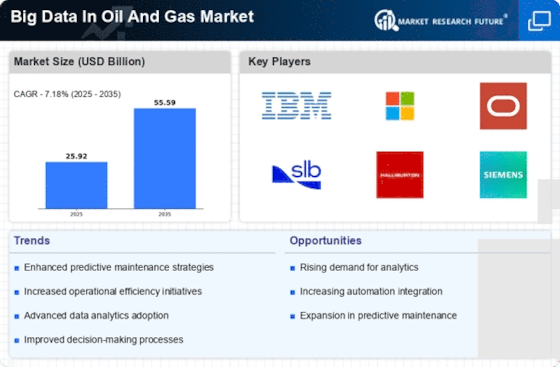

The Big Data In Oil And Gas Market is experiencing a surge in demand for advanced data analytics capabilities. Companies are increasingly leveraging sophisticated algorithms and machine learning techniques to analyze vast amounts of data generated from exploration and production activities. This trend is driven by the need to optimize operations, reduce costs, and enhance decision-making processes. According to recent estimates, the market for data analytics in the oil and gas sector is projected to reach USD 20 billion by 2026, reflecting a compound annual growth rate of approximately 15%. Enhanced data analytics not only improves operational efficiency but also aids in predictive maintenance, thereby minimizing downtime and maximizing productivity.

Increased Adoption of Cloud Computing

The adoption of cloud computing solutions is transforming the Big Data In Oil And Gas Market. By migrating data storage and processing to the cloud, companies can achieve greater scalability, flexibility, and cost-effectiveness. This shift allows for real-time data access and collaboration among teams, regardless of geographical location. As of 2025, it is estimated that over 60% of oil and gas companies will utilize cloud-based platforms for their data management needs. This transition not only streamlines operations but also enhances data security and compliance with regulatory standards, which is crucial in an industry that faces stringent oversight.

Growing Demand for Operational Efficiency

The quest for operational efficiency is a primary driver in the Big Data In Oil And Gas Market. Companies are increasingly focused on utilizing big data to streamline processes, reduce waste, and enhance productivity. By harnessing data analytics, organizations can identify inefficiencies in their operations and implement targeted improvements. For instance, predictive analytics can forecast equipment failures, allowing for timely maintenance and reducing unplanned downtime. This focus on efficiency is reflected in the projected market growth, with estimates suggesting a rise to USD 25 billion by 2027, as companies seek to maximize output while minimizing costs.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are critical factors influencing the Big Data In Oil And Gas Market. As regulations become more stringent, companies are compelled to adopt data-driven approaches to ensure compliance and mitigate risks. Big data analytics enables organizations to monitor operations in real-time, identify potential compliance issues, and respond proactively. This capability is particularly vital in an industry where non-compliance can result in substantial financial penalties and reputational damage. The market for compliance-related big data solutions is expected to grow significantly, driven by the increasing complexity of regulatory frameworks and the need for robust risk management strategies.