Integration of Advanced Analytics

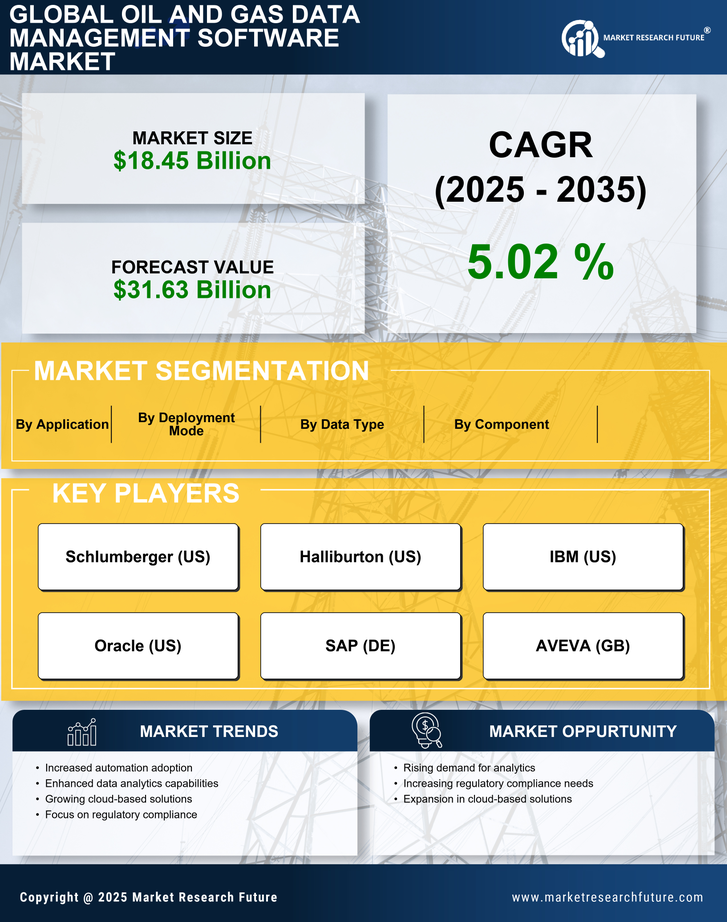

The integration of advanced analytics into the Oil And Gas Data Management Software Market is driving significant transformation. Companies are increasingly leveraging data analytics to enhance decision-making processes, optimize operations, and improve overall efficiency. According to recent estimates, the analytics segment within this market is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is attributed to the rising need for real-time data insights, which enable organizations to respond swiftly to market changes and operational challenges. Furthermore, the ability to predict equipment failures and optimize resource allocation through predictive analytics is becoming a critical factor for companies aiming to maintain a competitive edge in the industry.

Growing Importance of Data Security

As the oil and gas sector becomes increasingly digitized, the importance of data security within the Oil And Gas Data Management Software Market cannot be overstated. Cybersecurity threats pose significant risks to sensitive operational data, prompting companies to prioritize secure data management solutions. The market for cybersecurity in this sector is projected to grow at a rate of approximately 10% annually, reflecting the urgent need for robust security measures. Organizations are investing in software that not only protects data integrity but also ensures compliance with data protection regulations. This focus on security is likely to shape the development of future data management solutions, as companies seek to safeguard their assets against evolving cyber threats.

Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is reshaping the Oil And Gas Data Management Software Market, offering enhanced flexibility and scalability. Companies are increasingly adopting cloud technologies to facilitate remote access to data and improve collaboration among teams. This transition is expected to drive market growth, with cloud-based solutions projected to account for over 40% of the total market share by 2026. The advantages of cloud computing, such as reduced infrastructure costs and improved data accessibility, are compelling organizations to migrate from traditional on-premises systems. As the industry embraces digital transformation, the demand for cloud-based data management solutions is likely to continue its upward trajectory, reflecting a broader trend towards modernization in the sector.

Regulatory Compliance and Risk Management

The stringent regulatory environment surrounding the oil and gas sector necessitates robust data management solutions, thereby propelling the Oil And Gas Data Management Software Market. Companies are increasingly required to comply with various environmental and safety regulations, which demand accurate data reporting and management. The market for compliance-related software is expected to witness a growth rate of around 12% annually, as organizations seek to mitigate risks associated with non-compliance. Effective data management systems not only facilitate adherence to regulations but also enhance transparency and accountability within operations. This trend underscores the importance of investing in comprehensive data management solutions that can streamline compliance processes and reduce potential liabilities.

Demand for Enhanced Operational Efficiency

The relentless pursuit of operational efficiency is a primary driver in the Oil And Gas Data Management Software Market. Companies are under constant pressure to reduce costs while maximizing output, leading to an increased adoption of data management solutions. Recent analyses indicate that organizations utilizing advanced data management software can achieve operational cost reductions of up to 20%. This efficiency is largely attributed to improved data integration, streamlined workflows, and enhanced collaboration across departments. As the industry continues to evolve, the emphasis on leveraging data to drive efficiency will likely remain a focal point, encouraging further investment in innovative software solutions.