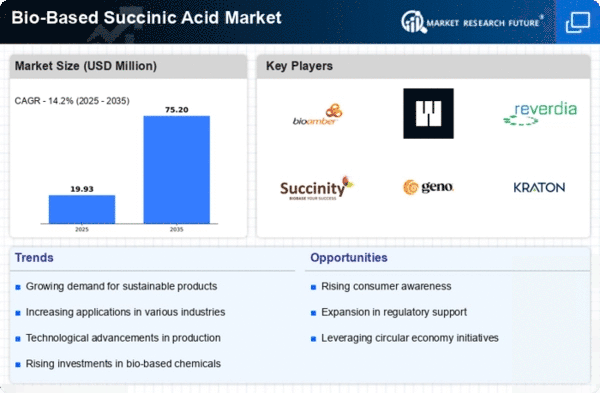

Market Growth Projections

The Global Bio-Based Succinic Acid Market Industry is projected to experience robust growth, with estimates indicating a market value of 900 USD Million in 2024 and a remarkable increase to 6445.9 USD Million by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 19.6% from 2025 to 2035, underscoring the increasing adoption of bio-based chemicals across various sectors. The market's expansion is driven by factors such as rising environmental awareness, technological advancements, and supportive government policies. These projections highlight the significant potential for bio-based succinic acid as a key player in the transition towards sustainable chemical production.

Government Support and Regulations

Government initiatives and regulations play a pivotal role in shaping the Global Bio-Based Succinic Acid Market Industry. Many countries are implementing policies that promote the use of bio-based products, offering incentives for manufacturers to adopt greener practices. For instance, subsidies and tax breaks for bio-based chemical production encourage investment in this sector. Additionally, regulations aimed at reducing greenhouse gas emissions further bolster the market. As a result, the industry is likely to witness accelerated growth, with projections indicating a market value of 6445.9 USD Million by 2035, driven by supportive governmental frameworks.

Growing Demand for Sustainable Chemicals

The Global Bio-Based Succinic Acid Market Industry experiences a surge in demand for sustainable chemicals, driven by increasing environmental awareness among consumers and industries. As companies strive to reduce their carbon footprints, bio-based succinic acid emerges as a viable alternative to petroleum-based chemicals. This shift is evident in various sectors, including automotive and packaging, where bio-based materials are preferred for their lower environmental impact. The market is projected to reach 900 USD Million in 2024, reflecting a growing inclination towards sustainable solutions. The trend indicates a significant transformation in chemical production, aligning with global sustainability goals.

Technological Advancements in Production

Technological innovations significantly influence the Global Bio-Based Succinic Acid Market Industry, enhancing production efficiency and reducing costs. Advances in fermentation technology and genetic engineering are enabling manufacturers to produce succinic acid more sustainably and economically. For example, the development of high-yield microbial strains has improved the fermentation process, leading to higher yields of bio-based succinic acid. These advancements not only lower production costs but also contribute to the overall sustainability of the industry. As a result, the market is expected to grow at a CAGR of 19.6% from 2025 to 2035, reflecting the impact of these technological improvements.

Rising Applications in Various Industries

The versatility of bio-based succinic acid drives its adoption across multiple industries, significantly impacting the Global Bio-Based Succinic Acid Market Industry. This compound finds applications in sectors such as pharmaceuticals, food additives, and biodegradable plastics, where it serves as a building block for various products. The increasing demand for biodegradable materials, particularly in packaging, further propels the market forward. As industries seek to replace conventional materials with sustainable alternatives, the bio-based succinic acid market is poised for substantial growth, aligning with global trends towards sustainability and environmental responsibility.

Consumer Preference for Eco-Friendly Products

Consumer preferences are shifting towards eco-friendly products, which is a crucial driver for the Global Bio-Based Succinic Acid Market Industry. As awareness of environmental issues rises, consumers increasingly favor products made from renewable resources. This trend is particularly evident in the personal care and cosmetics sectors, where brands are reformulating products to include bio-based ingredients. The growing demand for transparency in sourcing and production processes further emphasizes the need for sustainable materials. Consequently, manufacturers are responding to this shift by incorporating bio-based succinic acid into their formulations, thereby expanding the market and enhancing its growth potential.