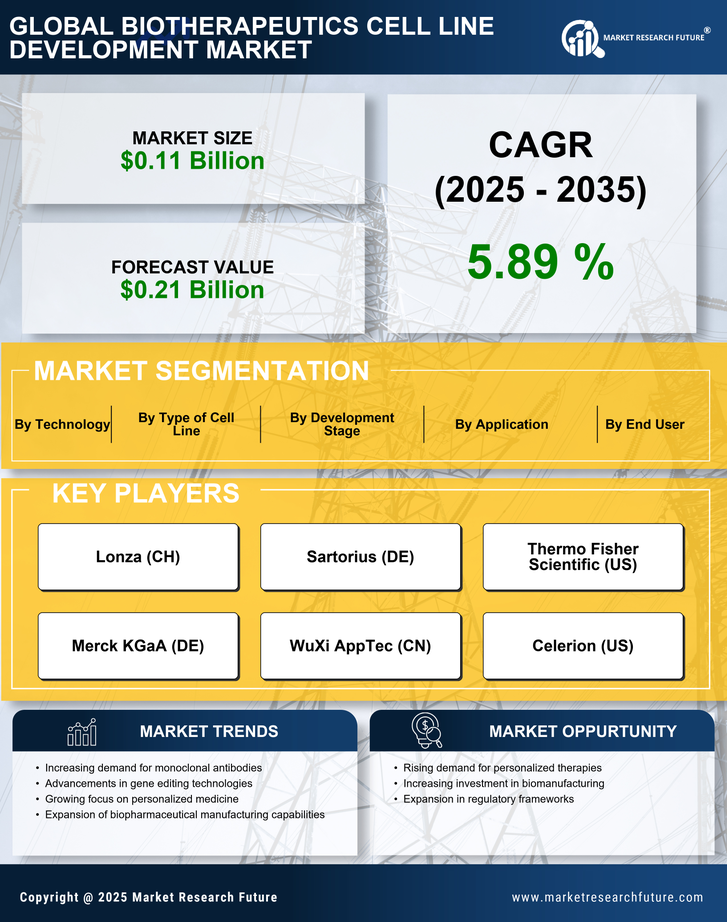

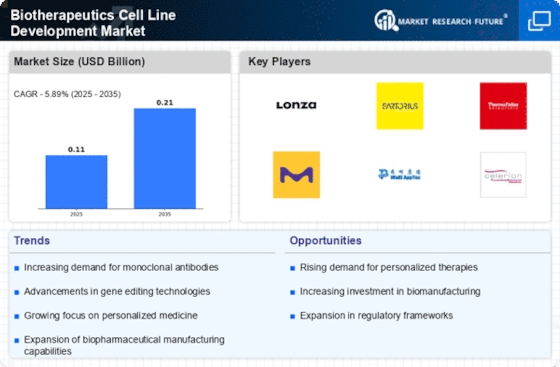

Rising Demand for Biologics

The increasing prevalence of chronic diseases and the aging population are driving the demand for biologics, which are often developed using cell lines. The Biotherapeutics Cell Line Development Market is witnessing a surge in the need for innovative therapies, particularly monoclonal antibodies and recombinant proteins. According to recent estimates, the biologics market is projected to reach over USD 500 billion by 2025, indicating a robust growth trajectory. This demand necessitates the development of efficient and reliable cell lines, thereby propelling the Biotherapeutics Cell Line Development Market forward. As companies strive to meet this demand, investments in advanced cell line development technologies are likely to increase, further enhancing the market landscape.

Regulatory Support for Biotherapeutics

The evolving regulatory landscape is playing a crucial role in shaping the Biotherapeutics Cell Line Development Market. Regulatory agencies are increasingly providing guidance and support for the development of biologics, which is fostering innovation and expediting the approval process. Initiatives aimed at streamlining regulatory pathways for cell line-derived products are likely to enhance market accessibility. As regulatory frameworks become more favorable, companies are encouraged to invest in cell line development, thereby driving growth in the Biotherapeutics Cell Line Development Market. This supportive environment is expected to facilitate the introduction of new therapies, ultimately benefiting patients and healthcare systems.

Increased Investment in Biopharmaceutical R&D

The Biotherapeutics Cell Line Development Market is benefiting from heightened investment in biopharmaceutical research and development. Pharmaceutical companies are allocating substantial resources to discover and develop new biologics, which often require sophisticated cell line development processes. In recent years, R&D spending in the biopharmaceutical sector has seen a steady increase, with estimates suggesting that it could exceed USD 200 billion annually by 2025. This influx of capital is likely to enhance the capabilities of cell line development, fostering innovation and efficiency within the Biotherapeutics Cell Line Development Market. As a result, companies are better positioned to meet the growing demand for effective therapies.

Technological Innovations in Cell Line Development

Technological advancements are reshaping the Biotherapeutics Cell Line Development Market, enabling more efficient and precise development processes. Innovations such as CRISPR gene editing, high-throughput screening, and automated cell culture systems are streamlining the creation of cell lines. These technologies not only enhance productivity but also improve the quality of the biotherapeutics produced. For instance, the integration of artificial intelligence in cell line development is expected to optimize workflows and reduce time-to-market for new therapies. As these technologies continue to evolve, they are likely to attract significant investment, further driving growth in the Biotherapeutics Cell Line Development Market.

Outsourcing Trends in Biopharmaceutical Manufacturing

Outsourcing has become a prevalent strategy in the Biotherapeutics Cell Line Development Market, as companies seek to reduce costs and enhance operational efficiency. By partnering with contract development and manufacturing organizations (CDMOs), biopharmaceutical firms can leverage specialized expertise and advanced technologies in cell line development. This trend is expected to continue, with a significant portion of biopharmaceutical production being outsourced. Reports indicate that the outsourcing market for biopharmaceuticals could reach USD 100 billion by 2025. This shift not only allows companies to focus on core competencies but also drives growth in the Biotherapeutics Cell Line Development Market, as CDMOs expand their service offerings.