Expansion of Biotechnology Companies

The expansion of biotechnology companies in the UK is a notable driver of the cell line-development market. The UK has become a hub for biotech innovation, with numerous startups and established firms focusing on developing advanced biopharmaceutical products. This growth is supported by a favorable regulatory environment and access to funding, which encourages the establishment of new ventures. In 2025, the number of biotech companies in the UK is projected to increase by 15%, further stimulating the demand for cell line development services. As these companies seek to develop novel therapies and vaccines, the need for high-quality cell lines becomes paramount. Consequently, the cell line-development market is likely to experience increased activity as biotechnology firms invest in developing and optimizing cell lines for their specific applications.

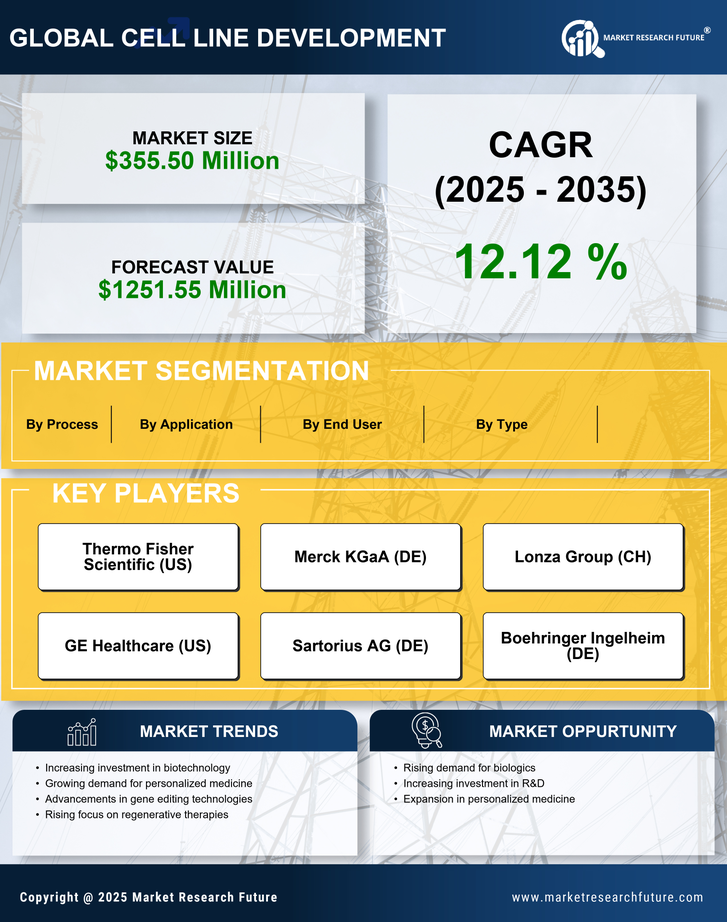

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a key driver in the cell line-development market. As the UK healthcare sector continues to evolve, there is a notable shift towards biologics, which are derived from living organisms. This trend is supported by the growing prevalence of chronic diseases and the need for innovative therapies. According to recent estimates, the biopharmaceutical market in the UK is projected to reach £30 billion by 2025, indicating a robust growth trajectory. This surge in demand necessitates the development of efficient and reliable cell lines, thereby propelling the cell line-development market forward. Furthermore, advancements in cell line technologies are likely to enhance the production processes, making them more cost-effective and scalable, which is essential for meeting the increasing market needs.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is emerging as a significant driver in the cell line-development market. As healthcare providers increasingly recognize the importance of tailoring treatments to individual patient profiles, the demand for specific cell lines that can mimic human responses is on the rise. This trend is particularly relevant in the UK, where the National Health Service (NHS) is actively promoting personalized treatment approaches. The cell line-development market is likely to see a surge in demand for customized cell lines that can facilitate the development of targeted therapies. Furthermore, advancements in genomics and proteomics are expected to enhance the ability to create cell lines that accurately represent patient-specific characteristics, thereby supporting the growth of personalized medicine initiatives. This focus on individualized treatment options is anticipated to drive innovation and investment in the cell line-development market.

Investment in Research and Development

Investment in research and development (R&D) plays a crucial role in the cell line-development market. The UK government and private sector are increasingly allocating funds to support innovative research initiatives aimed at advancing biotechnological applications. In 2025, R&D expenditure in the life sciences sector is expected to exceed £10 billion, reflecting a strong commitment to fostering innovation. This financial backing is vital for the development of novel cell lines that can be used in drug discovery and therapeutic applications. Moreover, the collaboration between academic institutions and industry players is likely to enhance the quality and efficiency of cell line development, further driving market growth. As a result, the cell line-development market is positioned to benefit significantly from these investments, leading to improved product offerings and enhanced competitiveness.

Advancements in Cell Culture Technologies

Advancements in cell culture technologies are significantly influencing the cell line-development market. Innovations such as 3D cell culture and bioreactor systems are enhancing the efficiency and scalability of cell line production. These technologies allow for more accurate modeling of human physiology, which is crucial for drug development and toxicity testing. In the UK, the adoption of these advanced technologies is expected to grow, driven by the need for more reliable and reproducible results in research and development. The cell line-development market is likely to benefit from these advancements, as they enable researchers to create more complex and physiologically relevant cell lines. This, in turn, could lead to improved outcomes in drug discovery and development processes, thereby fostering growth in the market.