Research Methodology on Bitumen Emulsifiers Market

The study focused on the global bitumen emulsifiers market is an exploration of the underlying dynamics and factors influencing the industry. Factors such as technology deployment, proprietary materials, government regulations, customer acceptance, and increasing investments in research & development are expounded in the report.

Research Objectives

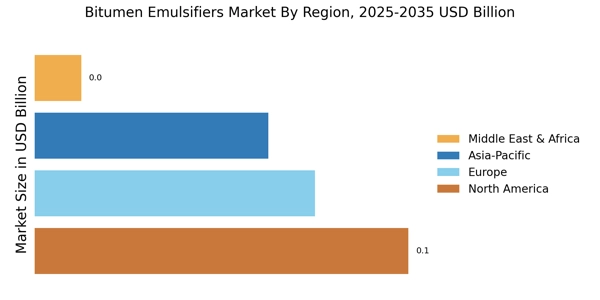

The study sought to estimate the bitumen emulsifiers industry for the period of 2023-2030. The main objective of the report included an extensive analysis of the historical, current, and future trends in the industry while highlighting the segmentation of the global bitumen emulsifiers market.

Information Procurement

Secondary research

In the primary stage of this report, secondary research was done to identify major players operating in the year 2023-2030. Information was gathered from published sources such as websites, journals, and annual reports of companies. Our primary sources also include industry associations such as The Association for International Bitumen Emulsifiers (AIBE) and the International Bitumen Emulsifier Manufacturing Association (IBEMA).

Primary research

Primary research was done through interviews with experts from the industry, including the companies’ stakeholders, industry observers, etc., in order to understand the macro perspectives and future prospects in the global bitumen emulsifiers market. Primary research provides a qualitative approach in terms of understanding industry and customer dynamics from a macro level.

Data triangulation

To develop accurate industry estimations and validate the market assumptions, a top-down and bottom-up approach was adopted. In the top-down approach, the overall market size was estimated based on the product and geographic segmentations in terms of total available data points for the market size. The bottom-up approach was used to derive numbers based on the distribution of the products across each region. These methods were used in combination to reach an accurate market size forecast.

Time-Series Analysis

Time series analysis was done for a detailed analysis of the market trends and capabilities. This was done by analyzing the historical data as well as the current data on current market trends and future developments.

Market Factors

Market factors and trends influencing the bitumen emulsifiers market were studied to assess the current landscape of the market and to determine the scope and size of the study. The other market factors included:

Demand and Supply Side Analysis

The demand and supply side analysis was conducted to identify the prevailing trends in the market as well as to understand the implications for the growth of the global bitumen emulsifiers market. This was undertaken to assess the pricing of the products, supply chain efficiencies, pricing structure, and PCs impacting the market dynamics.

Market Density

The market density included volume and revenue estimates of the global bitumen emulsifiers market for 2023-2030, segmented by type and geographic regions.