Research Methodology on Black Masterbatch Market

1. Introduction:

This report provides an overview of the current market for black masterbatch in terms of key drivers, trends, opportunities, and challenges. The methodology applied for the research included leveraging industry-standard primary and secondary sources to gain useful insights into the market. Data were gathered from interviews with key opinion leaders and subject matter experts in the industry, published reports, and white papers. The data was then analyzed and statistically modelled to provide the most accurate and actionable market data and insights.

2. Research Approach:

The research approach followed for this report included a combination of quantitative and qualitative research techniques to accurately analyze the market for black masterbatch. First, a comprehensive market sizing and scoping exercise were conducted to identify the sources of reliable data and the most appropriate method of analysis. An exhaustive, independent assessment of the market was then carried out, followed by a detailed qualitative investigation into market drivers, challenges, opportunities, trends, and the competitive landscape.

3. Data Collection:

The data collection process for this report included gathering data from both primary and secondary sources. Primary data was collected through interviews with key opinion leaders in the black masterbatch industry, as well as with customers from various end-user markets. Secondary data was gathered from published industry reports, white papers, press releases, and other sources.

4. Market Sizing and Scoping:

The research team first carried out a market sizing and scoping exercise to identify key data sources and the most appropriate method of analysis. This was done to ensure that the research methodology adopted was able to provide meaningful and actionable market insights.

5. Data Analysis:

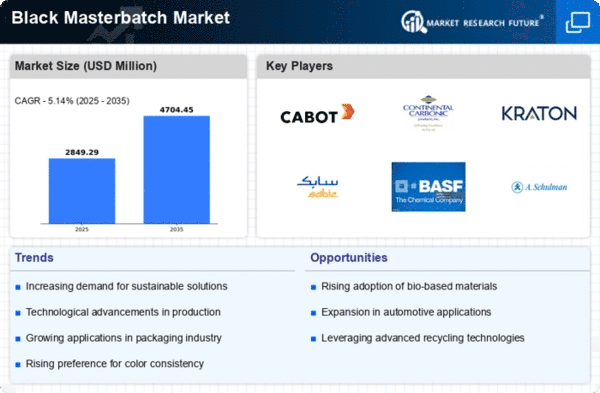

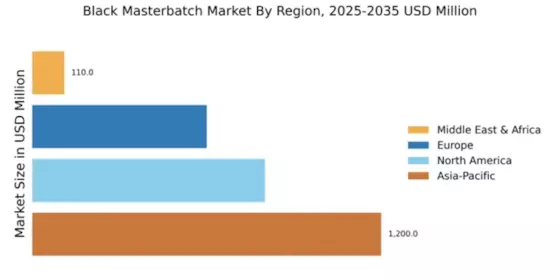

The data collected during the research process was then analyzed using several advanced statistical and analytical techniques such as market segmentation, market sizing, regression analysis, and SWOT analysis. The results of the analysis were then presented in the form of market intelligence tables, diagrams, charts, and other visuals.

6. Research Findings:

The research team was able to identify several key drivers, trends, and opportunities in the black masterbatch market. The findings of the research are discussed in detail in the report, and the key findings are summarized in the discussion section.

7. Conclusions:

The research concluded that the black masterbatch market is set to experience steady growth in the foreseeable future. Key drivers such as increasing demand from the automotive and packaging industries, rising disposable incomes, and technological advancements are leading to increased demand for black masterbatch. Furthermore, stringent regulations on vehicle emissions and coatings are driving the development of new and more efficient black masterbatch products. Overall, the conclusion was that there will be sustained growth in the black masterbatch market in the near future.