Market Share

Boiler Water Treatment Chemical Market Share Analysis

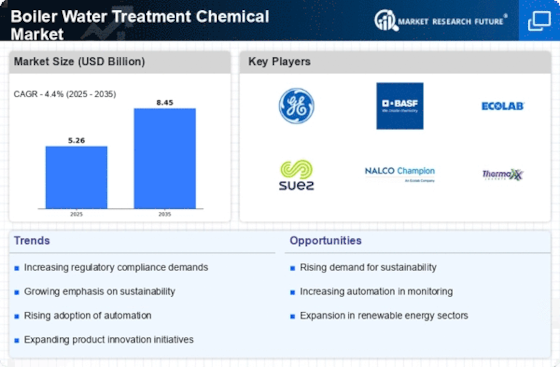

The Boiler Water Treatment Chemical market, which falls within the larger water treatment industry, employs different market share positioning strategies to thrive in a competitive environment. One key strategy involves focusing on product performance and innovation. Companies operating in the Boiler Water Treatment Chemical market keep on investing in research and development for them to improve the effectiveness of their chemical formulations. These companies develop new products that can address specific problems experienced when treating boiler water such as corrosion, scaling and microbial growth, which helps position them as leaders in the industry thus making their customers they serve to be attracted from technologically advanced and dependable water treatment options. Another important strategy employed by Boiler Water Treatment Chemical manufacturers is cost leadership. By optimizing manufacturing processes, ensuring efficient supply chain management, and achieving economies of scale, companies can offer cost-effective solutions. A company that offers boiler water treatment chemicals that are reliable yet affordable positions itself advantageously in a market where operational costs significantly influence purchasing decisions. Such a cost leadership approach attracts price-conscious consumers while bolstering its overall competitiveness within the marketplace. The positioning of Boiler Water Treatment Chemical manufacturers in market share is crucial for market segmentation. Companies targeting different industries like manufacturing, power generation and hospitality have designed specific marketing strategies as well as modifying their products to fit their intended applications. For example, water treatment requirements may differ between a hotel and a power plant. This segmentation enables penetration into multiple markets thereby addressing diverse water treatment challenges encountered by each segment and therefore consolidating their presence in various industrial segments. Moreover, geographical expansion also contributes to the market share positioning in the Boiler Water Treatment Chemical market. Since industries tend to vary from one region or country to another, companies prefer expanding their operations into these high demand markets strategically. These include partnerships with local dealers, setting up factories and making deals with top players across the water treatment industry. By locating themselves in regions that require much boiler water systems, organizations can reach new consumers while adapting to the varying practices of water treatment within specific areas hence fostering overall growth of market share.

Leave a Comment