Market Trends

Key Emerging Trends in the Boiler Water Treatment Chemical Market

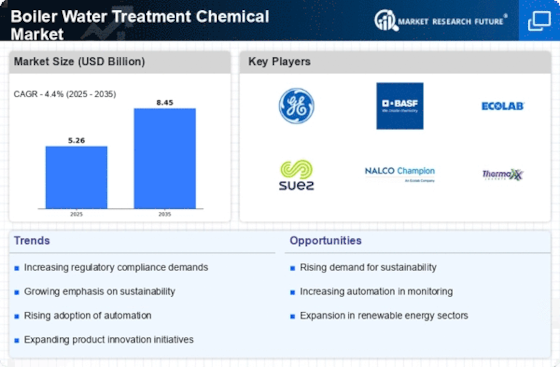

There are a number of notable trends in the Boiler Water Treatment Chemical market which underscore the importance of water treatment in maintaining efficiency and longevity of boiler systems across different industries. Increasingly complex industrial processes have led to higher demand for boiler water treatment chemicals aimed at solving water-related problems leading to optimal boiler performance.

One key trend in the Boiler Water Treatment Chemical market is emphasis on conservation and sustainability of water. Industries are installing advanced water treatment solutions that limit consumption and environmental impact. This means that boiler water treatment chemicals stop scale formation, corrosion or microbial growth promoting efficient use of water as well as sustainability of overall industrial operations

Boiler water treatment chemicals are heavily demanded by power generation sector due to extensive application of boilers in power plants. This comes against a backdrop where global energy landscape changes towards renewable sources hence making it necessary to maintain efficient and reliable boiler systems. The purpose is therefore ensuring protection against damage resulting from deposits buildup for instance; corrosion prevention through addition of inhibitors helps improve heat transfer efficiency along with reliability that ensures normal functioning within power industry facilities.

Asia-Pacific region is becoming an influential player within the global Boiler Water Treatment Chemical market. Rapid industrialization especially in China and India leads to increased usage rates on this type of substances in support for expanding manufacturing and electricity producing activities across those territories. Thus high level industry base coupled with infrastructure development boost Asia-Pacific’s rise throughout this region.

Technological advancements relating to water treatment technologies influence trends within the Boiler Water Treatment Chemical market. Continuous R&D focuses on developing innovative chemical formulations and treatment methods to improve performance of boiler water treatment chemicals. These advancements are aimed at enhancing better efficacy, reduced environmental impact, and cost effectiveness of water treatment processes.

Nevertheless, the non-volatile nature of these chemicals may lead to deposition formation which in turn lowers boiler thermal efficiency and causes shutdowns, hence necessitating tube repairs and deposit removal. Nonetheless, growing technological advancements increasing productivity relating to boiler water treatment chemicals are expected to stay with the market throughout the review period.

Leave a Comment