Growth in Renewable Energy Sector

The Booster Compressor Market is poised for growth due to the increasing investments in the renewable energy sector. As countries transition towards sustainable energy sources, the demand for booster compressors in applications such as biogas and hydrogen production is on the rise. These compressors play a vital role in enhancing the efficiency of gas extraction and transportation processes, which are critical for the viability of renewable energy projects. Market forecasts suggest that the renewable energy sector could see a compound annual growth rate of 8.5% over the next decade, further driving the need for efficient booster compressors. This trend not only presents opportunities for manufacturers to develop specialized products but also aligns with the global shift towards sustainable energy solutions, thereby reinforcing the importance of the Booster Compressor Market in the evolving energy landscape.

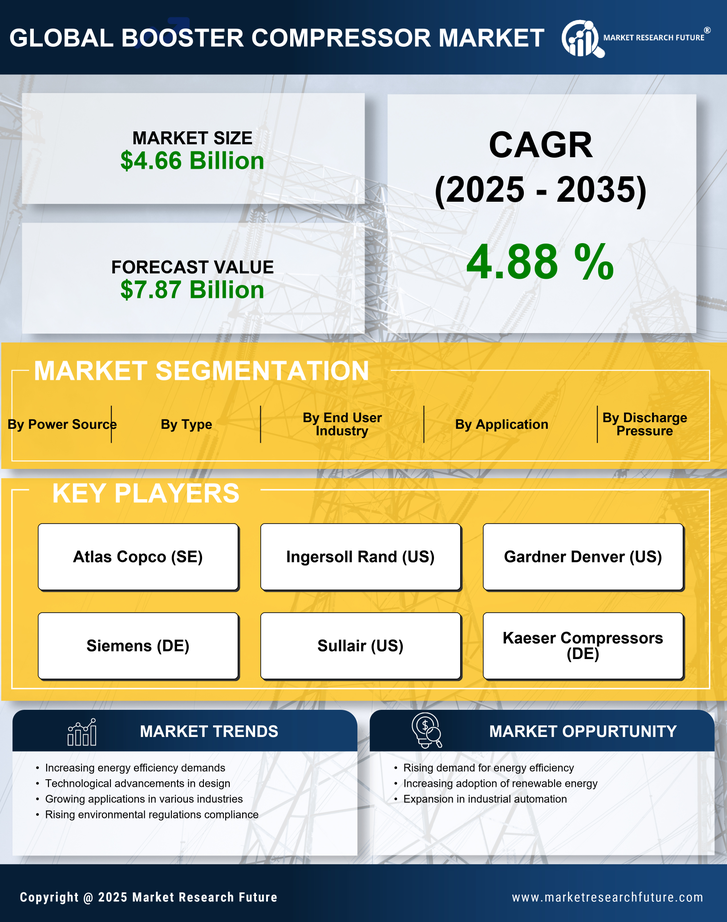

Rising Demand for Energy Efficiency

The Booster Compressor Market is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, the adoption of booster compressors that enhance energy efficiency becomes paramount. According to recent data, energy-efficient compressors can reduce energy consumption by up to 30% compared to traditional models. This trend is particularly evident in sectors such as manufacturing and oil and gas, where energy costs constitute a significant portion of operational expenses. Consequently, manufacturers are increasingly focusing on developing advanced booster compressors that not only meet regulatory standards but also provide substantial energy savings. This growing emphasis on energy efficiency is likely to drive innovation and investment within the Booster Compressor Market, fostering a competitive landscape that prioritizes sustainability alongside performance.

Expansion of Industrial Applications

The Booster Compressor Market is witnessing an expansion in its applications across various industrial sectors. Industries such as petrochemicals, food and beverage, and pharmaceuticals are increasingly utilizing booster compressors to enhance production efficiency and ensure product quality. For instance, in the petrochemical sector, booster compressors are essential for transporting gases and maintaining pressure in pipelines, which is critical for operational efficiency. Market data indicates that the demand for booster compressors in the food and beverage industry is projected to grow at a compound annual growth rate of 5.2% over the next five years. This diversification of applications not only broadens the market scope but also encourages manufacturers to innovate and tailor their products to meet specific industry needs, thereby driving growth in the Booster Compressor Market.

Technological Innovations in Compressor Design

Technological innovations are playing a crucial role in shaping the Booster Compressor Market. Recent advancements in compressor design, such as the integration of smart technologies and IoT capabilities, are enhancing operational efficiency and reliability. These innovations allow for real-time monitoring and predictive maintenance, which can significantly reduce downtime and maintenance costs. Furthermore, the introduction of variable speed drives in booster compressors enables better control over energy consumption, aligning with the industry's shift towards sustainability. Market analysts suggest that the adoption of these advanced technologies could lead to a 20% increase in efficiency for new compressor models. As manufacturers continue to invest in research and development, the Booster Compressor Market is likely to see a wave of new products that leverage these technological advancements, ultimately benefiting end-users.

Regulatory Compliance and Environmental Standards

The Booster Compressor Market is increasingly influenced by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations aimed at reducing greenhouse gas emissions and promoting energy efficiency. As a result, industries are compelled to adopt booster compressors that comply with these regulations, driving demand for advanced, eco-friendly solutions. For instance, the introduction of the European Union's Ecodesign Directive has set specific energy efficiency requirements for compressors, pushing manufacturers to innovate. Market data indicates that compliance with these regulations can enhance a company's market position and reduce liability risks. Consequently, the focus on regulatory compliance is likely to propel growth in the Booster Compressor Market, as companies seek to align their operations with environmental standards while maintaining competitive advantages.